Auckland Property & NZX Stock Market Tips with MaximSherstobitov.NZ

By www.MaximSherstobitov.NZ

Auckland Property & NZX Stock Market Tips with MaximSherstobitov.NZJul 30, 2020

News & Review Sanford, PushPay, Z Energy ($12,929 Portfolio)

Auckland weekly rent price hit near all-time high / Reviews Synlait, Pushpay, Z Energy and other top news of the last 7 days / The big mistake that I made in my investment portfolio .

TABLE OF CONTENTS

0:00 News Topics.

0:23 Auckland weekly rent price hit near all-time high

1:27 NZX 50 vs ASX 200 vs SP500

3:04 Sanford Stock Update (SAN - NZX)

4:03 Synlait Stock Update (SML - NZX)

5:23 PushPay Stock Update (PPH - NZX)

8:23 Fletcher Building Stock Update (FBU - NZX)

9:01 Z Energy Stock Update (ZEL - NZX)

10:33 My Public Portfolio Update $12,929

➔ Learn other tips at https://www.MaximSherstobitov.NZ/

➔ Subscribe now so you do not miss the next video https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Like the video, if you want to see more of this kind of content

➔ Comment below - I read every single one!

Facebook Page https://www.facebook.com/MaximSherstobitovPage/

Instagram https://www.instagram.com/maxim.sherstobitov/

Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

LinkedIn https://www.linkedin.com/in/maximsherstobitov/

Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

NZ Investing Tips in Uncertain Times (by Cameron Bagrie)

Economist Cameron Bagrie will share his opinion on the current opportunities and how to invest through the next months and years as the world continues to battle the pandemic.

➔ Learn other tips at https://www.MaximSherstobitov.NZ/

➔ Subscribe now so you do not miss the next video https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Like the video, if you want to see more of this kind of content

➔ Comment below - I read every single one!

Facebook Page https://www.facebook.com/MaximSherstobitovPage/

Instagram https://www.instagram.com/maxim.sherstobitov/

Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

LinkedIn https://www.linkedin.com/in/maximsherstobitov/

Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

Skellerup (SKL-NZX) CEO Review & Outlook - October 2020

Skellerup is a New Zealand-based manufacturer of industrial and agricultural rubber products. now employs over 800 people in NZ, Australia, the UK, US and China.

Highlights for the year ending 30 June 2020

· Resilience and skill of our people to sustain business operations in a challenging environment.

· Revenue of $251.4 million, up 2% on pcp.

· Earnings before interest and tax (EBIT) of $42.5 million, up 2% on pcp.

· Agri Division EBIT of $25.4 million, up 11% on pcp.

· Industrial Division EBIT of $20.9 million, down 9% on pcp.

· Net profit after tax (NPAT) of $29.1 million, in line with pcp.

· Operating cash flow of $48.0 million up 66% on pcp.

· Final dividend of 7.5 cps (50% imputed) bringing the total dividend to 13.0 cps (50% imputed) for the full year, in line with pcp.

Skellerup financial results overall are in line with the prior corresponding period (pcp) record result despite the impact of Covid-19 restrictions on both the supply chain and markets globally.

The performance reflects the resilience and robustness of the business and highlights the benefit of providing essential products, particularly in the Agri Division, to international markets.

Agri Division EBIT was a record $25.4 million. CEO David Mair said the result underscored the importance of the essential dairy consumables products that Skellerup design, manufacture and sell globally.

“The strength and resilience of our Agri business is seen in the record result. We increased sales of essential rubber ware products into the USA, achieved operational gains despite the impact of COVID-19 restrictions at our key Wigram facility and had a strong contribution from Silclear, our silicone rubber products business acquired on 01 November 2020.”

Industrial Division EBIT was $20.9 million, down 10% on the record result achieved in the pcp. Mair said results varied across the Division reflecting the diversity of customers and applications served.

What are your thoughts on it?

➔ Learn other tips at https://www.MaximSherstobitov.NZ/

➔ Subscribe now so you do not miss the next video https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Like the video, if you want to see more of this kind of content

➔ Comment below - I read every single one!

Facebook Page https://www.facebook.com/MaximSherstobitovPage/

Instagram https://www.instagram.com/maxim.sherstobitov/

Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

LinkedIn https://www.linkedin.com/in/maximsherstobitov/

Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

MHM Automation (MHM-NZX) CEO Review & Outlook - October 2020

MHM has transitioned to a technology-led future through divesting non-core businesses and operational changes. Financial year to 30 June 2020 saw EBITDA increase 199% to $2.4m.

The original MHM Automation Limited company was established in 1884 by Mr James Mercer in Christchurch, New Zealand.

MHM Automation, now with four New Zealand manufacturing plants, has grown to become an international leader in the design and manufacture of innovative technology solutions and the fabrication of stainless steel products.

Following the restructuring in 2015, MHM Automation seeks to generate long-term shareholder value by focusing on its portfolio of food processing and packaging IP which are sold globally while continuing to drive efficiencies in its core fabrication business.

In addition, MHM Automation is seeking to commercialise the S-Clave technology and get it into market within a compressed time frame.

The following information was extracted from MHM Automation Limited's full year results, released 25 August 2020:

Highlights for the 12 months to 30 June 2020:

• Revenue of $51.6m, an increase of 35% over the prior year

• Automation 81% of group sales revenue vs 61% for the prior year

• Automation revenue increased 79%

• EBITDA $2.4m a 199% increase on the prior year’s EBITDA of $0.8m

• After tax profit was $0.9m, an increase of $1.9m on the prior year.

• Milmeq acquisition completed for a value of $50,000 and the repayment of the $1m interest free vendor financing

In the 2020 financial year, revenue increased 35% to $51.6m, driven by a $18.5m revenue increase in the Automation business. The Automation business reported revenue of $41.8m, which was 81% of total group revenue.

The full year contribution of Milmeq products was a key driver to the year on year growth, which aligns with our stated strategy of being an automation lead business. This also changed our revenue profile to be more Australasian domiciled. This increasing diversification of products and markets is another strategic goal that we continue to work on.

Would you invest in it?

➔ Learn other tips at https://www.MaximSherstobitov.NZ/

➔ Subscribe now so you do not miss the next video https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Like the video, if you want to see more of this kind of content

➔ Comment below - I read every single one!

Facebook Page https://www.facebook.com/MaximSherstobitovPage/

Instagram https://www.instagram.com/maxim.sherstobitov/

Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

LinkedIn https://www.linkedin.com/in/maximsherstobitov/

Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

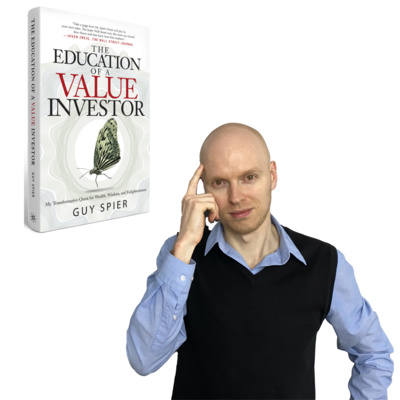

5 Stock Market Investing Habits You Must Follow (#4 is Key!)

To make better investment decisions, it helps to develop a series of easy rules that you can apply consistently. This will reduce the number of mistakes and speed your process.

Your will learn the 5 habits from a successful investor, Guy Spier.

Guy Spier is a Zurich-based investor and author of a book on investing entitled The Education of a Value Investor.

He is well known for bidding US$650,100 with Mohnish Pabrai for a charity lunch with Warren Buffett on June 25, 2008.

What's your most favourite investment rule?

➔ Learn other tips at https://www.MaximSherstobitov.NZ/

➔ Subscribe now so you do not miss the next video https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Like the video, if you want to see more of this kind of content

➔ Comment below - I read every single one!

Facebook Page https://www.facebook.com/MaximSherstobitovPage/

Instagram https://www.instagram.com/maxim.sherstobitov/

Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

LinkedIn https://www.linkedin.com/in/maximsherstobitov/

Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

Review Fisher & Paykel (FPH-NZX) / Mainfreight (MFT-NZX)

Stock prices remain underpinned by (1) central banks commitment to near-zero interest rates, (2) a V-shape recovery in a number of sectors, and (3) a medical treatment for COVID-19.

F&P Healthcare (FPH) has developed specialised expertise in heated humidification that forms the basis of its strong market position in the hospital and growing presence in homecare.

It has progressively widened its addressable market through new applications which is a key driver of an attractive, long-term, double-digit profit growth outlook.

The company is also benefiting from COVID-19 related demand, with some of its products recommended as a front-line therapy.

However, FPH is one of the most expensive global medical device companies (growth-adjusted and absolute).

While it is difficult to foresee a catalyst for a derating, particularly given near-term earnings momentum, we see better value for risk elsewhere.

Second quarter 2020 results from Mainfreight's (MFT) key global peers highlight material decline in freight demand as a result of COVID-19, but resilient margins across most industry segments.

MFT released its corresponding quarterly results at its Annual Shareholder Meeting on 30 July 2020, highlighting a stellar quarter, with revenue up +8% and pre-tax profit up +20% on the same period last year.

Its superior performance in the context of broader industry profitability decline highlights its best-in-class characteristics and continued strong growth potential.

MFT is trading at a one year forward PE of ~26x, a discount to its closest but significantly larger peers.

This webinar is presented Milford Asset Management.

➔ Learn other tips at https://www.MaximSherstobitov.NZ/

➔ Subscribe now so you do not miss the next video https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Like the video, if you want to see more of this kind of content

➔ Comment below - I read every single one!

Facebook Page https://www.facebook.com/MaximSherstobitovPage/

Instagram https://www.instagram.com/maxim.sherstobitov/

Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

LinkedIn https://www.linkedin.com/in/maximsherstobitov/

Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

NZ Tech Stocks You Should Consider & Cheaper Money in 2020

The Reserve Bank kept the official cash rate at 0.25%, and is continuing to print money. Why are they trying to increase inflation & lower borrowing costs to households and businesses?

✅ Timestamps ✅

0:00 News Topics.

0:27 The Reserve Bank to Give Cheap Funding Directly to the Banks Possibly as Soon as November

1:20 NZX Stock Market Top 10 Winners and Losers

1:49 Australian government to scrap responsible lending laws (Westpac, ANZ and Heartland Bank)

2:56 Pushpay Stock Update (PPH - NZX)

4:16 Hallenstein Glassons Stock Update (HLG - NZX)

5:50 Kathmandu Stock Update (KMD - NZX)

7:41 Turners Automotive Stock Update (TRA - NZX)

9:25 My Public Portfolio Update $11,442

Westpac, which recently won a lengthy court case against the regulator over alleged breaches of the lending rules, led the market higher as it surged 6%.

ANZ jumped 5% and local lender Heartland Group - which has Australian reverse mortgage operations - actually lost 4% over the last week.

Before we move to the next stock, I wanted to thank you for leaving me comments and ideas. I don’t want to just talk at the camera. It’s awesome to read your feedback too!

Pushpay - Now we are going to review Pushpay share price which is up by 8% over the last week. The stock climbed as more brokers gave them the thumbs up with upgrades. Pushpay has made some good developments, and churches in the United States are looking to connect with members online and through mobile phones because of the Covid crisis. The number of churches moving to new technology has increased from 45% to 80%.

Research firm Jarden upgraded the stock to ‘outperform’ and hiked its 12-month target price from $7.90 to $9.30.

That's a substantial jump, but still behind Forsyth Barr's, who on September 10 increased their 12-month target from $12 to $13.

2021 will be a remarkable year for Pushpay, with the shift to digital donations accelerating significantly, and its platform becoming indispensable to clients. We now expect to see three years' worth of growth compressed into one, bringing a 55% increase in donation volume and corporate earnings growth of 128%.

What do you do with this company? Do you follow the target prices from brokers? Let me know in the comments below?

Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe on YouTube now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

➔ Instagram - https://www.instagram.com/maxim.sherstobitov/

➔ LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

➔ Subscribe to the Podcast

➔ Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

Is NZ Recession Really Over & Little-Known Facts (Week 5)

The deepest recession in NZ history. What’s behind it? / NZ Share Market Rises and Falls Over the Last Week/ My 4 Company Losers and 2 Winners ($11,021 Stock Portfolio Update)

✅ TABLE OF CONTENTS ✅

0:00 News Topics.

0:26 The deepest recession in NZ history.

3:12 Heartland Group Stock Update (HGH - NZX)

5:24 Serko Stock Update (SKO - NZX)

5:57 Tourism Holdings Stock Update (THL - NZX)

7:08 Enprise Group Stock Update (ENS - NZX)

8:34 My Public Portfolio Update $11,021

If you look at this chart we must be all in trouble. And I’m talking about WW2 trouble because we have not seen such GDP drop since 1930.

However, something really bizarre is happening. GDP chart is down but the NZX 50 is going up. There is a big disconnect from the real economy and the stock or the property market. One of the main reasons is that the NZ government is handing out a lot of money and RBNZ reduced the Official Cash Rate close to zero.

Since investment earnings are scarce in a recession with zero or negative interest rates, investors are flocking to anything promising capital gains. Equity, real estate or even rare whiskeys are attractive alternatives to watching your money melt away in real terms.

Last week, the Real Estate Institute of New Zealand (REINZ) released its latest property price statistics. In the past year, the median house price increased by 16%.

If you thought there was an economic crisis or a recession going on, it does not show up in insolvency proceedings too. For the six months of March to August, 481 bankruptcy adjudications were sent to the High Court. That was 23% below last year's figure, 40% fewer than in 2018 and 56% below the 2017 numbers.

In New Zealand, a 12% plunge in June quarter gross domestic product (GDP) was the worst result since records began in 1987, but a fall of that magnitude, reflecting the coronavirus lockdown, had been expected.

However, all the padding around this economic crisis makes it look like a boom. Globally, governments have moved trillions of dollars to prop up businesses, subsidise workers, support the unemployed and run shovel-ready projects. Meanwhile, central banks are printing trillions of dollars and lowering interest rates to keep governments financed and businesses afloat.

What do you think will happen when this support is over?

Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe on YouTube now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

➔ Instagram - https://www.instagram.com/maxim.sherstobitov/

➔ LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

➔ Subscribe to the Podcast

➔ Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

Future of NZX Stock Market & My Portfolio Update (Week 4)

Top Share Rises and Falls Over the Last Week. My 5 Company Losers and 1 Winner (Stock Portfolio Update). You will learn what's been happening with Briscoes, Cannasouth and others!

✅ TABLE OF CONTENTS ✅

0:00 News Topics.

0:22 Why NZX Stock Market Declined

1:35 Briscoes Stock Update (BGP - NZX)

2:33 Serko Stock Update (SKO - NZX)

4:59 Asset Plus Stock Update (APL - NZX)

5:58 Cannasouth Stock Update (CBD - NZX)

6:32 Sky Network Stock Update (SKT - NZX)

8:33 My Public Portfolio Update $10,685

Let’s talk about Briscoes group. Its share price is up by 4 % after the company posted a first half profit of $28 million.

Revenue was reported at $292 m (-3.5%) after a recessive first half (-35% in sales). It was bolstered by a strong rebound in the second quarter (+28%). Better than expected results happened even though its homeware and sporting goods stores were closed for 50 days during the six months ending July.

Online sales performed especially well; doubling compared to the same period last year. In other words, It grew 100 per cent in that period.

Investors may also have been pleased to see an interim dividend of 9cps, an increase from last year's first half pay-out.

Next is SERKO. The corporate travel management software was one of the biggest movers, which rose 5% after it was announced last Friday that it would be replacing New Zealand Refining's spot in Standard & Poor's NZX 50 index. The rebalance will be effective on September 21 and will have several implications for both stocks.

Investors may like the prospect of increased demand for the stock from passive funds, which may in theory have a positive effect on the stock price. As more money flows into funds and Kiwisaver accounts that invest in the index, new units in the funds must be created, which requires purchase of additional stock in the fund components – in this case, Serko.

I’d be careful because it is another stock that is financially struggling but will be propped up.

Serko has unstable earnings over the last 4 years. It made a loss of $9m in the June 2020 year and was unable to provide a forecast for 2021 given the impact of Covid-19.

Looking forward, with the acquisition of Metlifecare by Asia Pacific Village Group currently proceeding, brokers Forsyth Barr suggested that the most likely replacement on the index would be either Tower or Hallenstein Glasson.

You may take advantage of it!

Now we move to the cannabis stock. This week Cannasouth shares rose 15% after the company gained popularity ahead of the upcoming referendum. (Show 1 month prices) To me it seems like someone is trying to manipulate the stock because it is up by 100 % then down 40% when there were no fundamental changes in the company.

Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe on YouTube now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

➔ Instagram - https://www.instagram.com/maxim.sherstobitov/

➔ LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

➔ Subscribe to the Podcast

➔ Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

5 Key Investment Lessons & Why Your NZ Share Values Are Down

TABLE OF CONTENTS:

0:00 News Topics.

0:31 August Stock Performance Review

1:39 Why US Stock Market Plunges

2:06 NZX Market Weekly Results

3:31 SkyCity Stock Update (SKC - NZX)

5:16 PushPay Stock Update (PPH - NZX)

6:05 Asset Plus Stock Update (APL - NZX)

6:35 a2 Milk Stock Update (ATM - NZX)

7:11 Abano Healthcare Stock Update (ABA - NZX)

7:57 Air NZ Stock Update (AIR - NZX)

8:22 Vista Group Stock Update (VGL - NZX)

9:16 5 Key Investment Lessons

10:35 My Public Portfolio Update $10,594

The previous month August 2020 recorded big volatility in the stock market. Some shares are up by 100%. Good time to be a trader if you have deep pockets and know how to do it. Otherwise, you lose money so stay away if you don’t have advanced skills.

Now let’s look at what's been happening as of the last week, the American market had the biggest one-day falls since June, caused by profit-taking after weeks of record-setting rises and further concern about the United States-China relations. Nasqaq down by 9% at one point.

Investors moved money out of the tech stocks which could get hit the hardest from potential tariff increases.

Because nearly one third of NZX investors are based overseas, the NZ stock market drop followed a sell-off in the US market, particularly in the tech stocks.

However over the last week, share prices came through better than expected.

It was still an ugly reporting season compared with previous years, but compared to expectations it wasn't too bad.

As always, fund managers were seeking meaningful "outlook" statements as to how companies might do in the year ahead.

For the most part, they came up empty-handed. Not a lot of businesses have got certainty.

NZX 50 is down by 2% over the last week.

Dividends, in these days of ultra-low interest rates, come into sharper focus.

We have seen a lot of companies either reduce, or suspend dividends - companies you would usually see as reliable dividend payers.

Do you think now is a good time to invest in any of the NZ tech stocks or should we stay away? Let me know in the comments below. PushPay and Fisher & Paykel were one of the biggest losers last week.

Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe on YouTube now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

➔ Instagram - https://www.instagram.com/maxim.sherstobitov/

➔ LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

➔ Subscribe to the Podcast

➔ Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

Why NZX 50 Hit an All-Time High & What NZ Stocks I Bought

Cyber Attacks on the NZ stock exchange, why NZX 50 hit an all-time high, my 3 company losers and 1 winner over the last week. You will learn all that and other top news digest.

The exchange has been hit 4 days in a row with DDoS attacks since Tuesday which have shut down trading.

The attack landed in the biggest week of earnings season, pulling attention away from the 10 companies in the top 50 reporting earnings.

NZX Ltd share price did not suffer much. It dropped only 1% after a week of cyber-attacks.

They’ll be doing a lot of soul searching and figuring out where they need to spend more money to make the system solid. We can’t have this going on.

Neither cyber attacks nor the Covid disruption could stop this. Against all odds, the New Zealand sharemarket hit a new all-time high. It passed the previous record of 12,070 set on February 21 this year.

When the index hit a low of 8500 points on March 23, just before the nationwide Covid lockdown, few if any would have foreseen it reaching new heights within 5 months as economic uncertainty became the new normal.

While businesses closed, job losses mounted, and the government kept pumping in new financial support, the sharemarket was unshaken, rising an unexpected 37%.

It was fuelled by the low interest rates and a rush of new investors – online trading platform Sharesies took on 95,000 extra customers during the lockdown – looking to place their money elsewhere than in the low deposit rates of the banks.

ANZ announced that they predict the RBNZ will cut the official cash rate to -0.25% in the first half of next year. One thing negative interest rates will drive upward the stock prices, with investors seeking growth, return and yield.

Cannasouth which announced its six months result, showing revenue of $58,000 and a loss of $1.5m compared with a loss of $820,000 for the previous corresponding period. The medicinal cannabis company has cash on hand of $11m, and its share plunged 37% from an all-time high.

Investors are speculating on the outcome of the cannabis referendum now that medicinal cannabis is already legal, and a lot of volume is coming into the share trading.

Vista Group. The share price surged by 19% after its first half result, reporting revenue of $45 million, down -34% from the same time last year, as well as EBITDA of -$6.5 million. Despite the loss, the market had anticipated a more negative result. Investors may have liked a comment from management that the company is seeing 'early indications' of reasonable demand once new content is available.

Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe on YouTube now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

➔ Instagram - https://www.instagram.com/maxim.sherstobitov/

➔ LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

➔ Subscribe to the Podcast

➔ Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

How to Invest $10,000 & NZX Stock Market News (23 Aug 2020)

The market was heartened by Prime Minister Jacinda Ardern's update in the battle against the virus outbreak.

*** Medicinal cannabis stock Cannasouth jumped 50% over the last week.

This was despite getting a ‘’please explain’’ from the NZX for the rapid rise this week, to which the company stated it had not breached disclosure rules.

The stock has been rising in anticipation of the recreational cannabis referendum and a growing medicinal cannabis industry.

Do you think now is a good time to invest in Cannasouth or should we stay away? Let me know in the comments below.

*** a2 Milk For the year ending June, the company reported a 34% increase in net profit to $385m on revenue of $1.7 billion, up 33%.

a2 Milk doubled sales in China to $337m and expanded distribution to 19,000 stores. The China label now makes up a quarter of a2 Milk's global infant formula business.

The share price declined 3.3% because the numbers were in line with the middle of the company’s guidance range, but the expectation had been for the result to be at the top of the range.

When you are priced for perfection anything less is going to see your share price come back.

However, the stock recovered a bit after announcing it was looking to buy 75% of Mataura Valley Milk for approximately $270 million to add in-house manufacturing capability.

China Animal Husbandry Group will retain the remaining 25% shareholding.

*** Hallenstein Glasson. On the flipside, people expected the worst with Hallenstein Glasson and it wasn't. It coped well, paying a good dividend and we see a lift in their share price.

It jumped 31% after the clothing retailer said online channels helped to keep annual sales stable through the pandemic lockdowns. Online sales grew 80%.

Overall sales increased 0.1% despite the interruption from pandemic lockdowns, profit declined just 6% to 27m and the retailer declared an interim dividend of 15 cents per share.

It is an example of retail business rolling with the punches and finding new ways to reach their customers. In a yield-starved market that dividend starts to look pretty attractive.

*** Metro Performance Glass shares jumped 19% after the company said its Australian business was profitable in the four months through July.

Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe on YouTube now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

➔ Instagram - https://www.instagram.com/maxim.sherstobitov/

➔ LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

➔ Subscribe to the Podcast

➔ Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

AFT Pharmaceuticals (NZX-AFT) Stock Review & Growth Trends

AFT reported a strong lift in revenue and earnings following sales growth and cost control in its diversified Australasian medicines business and growing sales of its Maxigesic drug.

This talk is presented by Hartley Atkinson - CEO - AFT Pharmaceuticals Ltd.

Revenue for the year to 31 March 2020 increased 24% to $105.6 million from $85.1 million in the prior financial year, with revenue growing strongly in Australia (up 22%), New Zealand (up 12%) and Asia (up 130%). The international business, which is focused primarily on the commercialisation of Maxigesic was up 55%.

Operating profit rose to $21.1 million, building on last year's $6.1 million operating profit by $15.0 million. The result included a non-cash $9.8 million non-recurring gain related to AFT taking full control of the Pascomer dermatological medicine2 intellectual property.

Excluding the one-off gain, the underlying operating profit of $11.4 million represented an 86% improvement on the prior year's result and reflects continued sales growth, the return to more normalised research and development spending and careful management of costs throughout the business.

Net profit after tax rose to $12.7 million from a loss of $2.4 million in the same period a year ago, demonstrating the operating leverage present in our business

AFT Pharmaceuticals Chairman David Flacks said: "The Board is delighted to report on an outstanding year. For the first time we broke through $100 million sales and delivered record earnings.

"Momentum has continued to build across our business in the last financial year. Our Australasian business continues to grow strongly extending a two-decade record of growth."

Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe on YouTube now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

➔ Instagram - https://www.instagram.com/maxim.sherstobitov/

➔ LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

➔ Subscribe to the Podcast

➔ Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

What NZ Fund Managers Buy During Uncertain Times - And Why

Planning for your financial future while everything about work and life has changed drastically is causing you to wonder: How do you create & manage wealth in this new world?

Click SHOW MORE to read the rest

This webinar is presented by Felix Fok from Milford Asset Manager.

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

Like the video, if you want to see more of this kind of content

Comment below - I read every single one!

Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

Instagram - https://www.instagram.com/maxim.sherstobitov/

Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

How to Invest in Stocks for Beginners NZ (Shares, ETFs)

If you want to enjoy financial freedom then you have to understand how the stock market works, how to structure your portfolio, and how to handle different types of risks.

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

Like the video, if you want to see more of this kind of content

Comment below - I read every single one!

Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

Instagram - https://www.instagram.com/maxim.sherstobitov/

Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

NZX Stock Market 7-Day Review & Economy News (16 Aug 2020)

The new restrictions cast a shadow over the NZ market as the NZ Prime Minister Jacinda Ardern announced that alert level 3 in Auckland would be extended for 12 days.

She said there is nothing to suggest a move to alert level 4 was required.

The market was down 2.5% in early trading - its biggest fall in two months - but went up as investors processed the impacts of the lockdown and the Reserve Bank announced further stimulus which will support financial markets.

The shutdown will have a limited effect, at this stage, as it is not nationwide, and many companies have rebuilt their balance sheets to be more resilient.

Let’s review about the troubled stock AMP climbed 12% after reporting a special dividend and a $200 million share buyback programme after the sale of its life insurance division.

Sometimes, such an approach may indicate a company sees few opportunities to actually invest cash back into the business.

Let’s talk about Heartland Group Holdings, a regional bank that may be exposed to mortgage defaults, fell 7%. However, ANZ and Westpac climbed 7% and 9% respectively.

That’s because they had dividend party in Australia! Westpac and ANZ led the rise in financials, after Commonwealth Bank of Australia reported their full year earnings, with a solid dividend. Despite their full-year cash profit falling, a robust balance sheet and the bank paying the maximum dividend allowed in this environment, the result is generally a positive sign for the sector.

Next is Retail property investor Kiwi Property Group which declined 6%. Sylvia Park is a massive part of the company’s assets, so lockdown will have a big impact that investors are trying to price in.

However, were you surprised by the traffic jams during Level 1 and Level 2? Not all people are working from home. We still go to offices and shops. Therefore, investors realise this virus will go away and commercial property will enjoy some demand. Yes, it won’t be 99% occupancy but still high enough to offer good return on investment.

Let’s talk about aged-care providers. Arvida and Oceania who saw some losses as investors were concerned about exposure to elderly communities which are at higher risk to covid-19. Arvida and Oceania had the sector’s biggest loss, falling 7%. However, the swift tightening of companies’ protocols who can enter the retirement village and other health & safety rules cushioned the stock falls.

Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe on YouTube now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

➔ Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

➔ Instagram - https://www.instagram.com/maxim.sherstobitov/

➔ LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

➔ Subscribe to the Podcast

➔ Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

NZ Property Investing in 2020: How to Avoid Costly Mistakes

It is harder to borrow money for a rental property than for your own home. NZ Banks will follow certain guidelines to work out what you can afford to repay when we're borrowing money.

This webinar is presented by John Bolton from Squirrel mortgage brokers.

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

Subscribe now on YouTube so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

Instagram - https://www.instagram.com/maxim.sherstobitov/

Subscribe to the Podcast

LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

NZX Stock Market 7-Day Review & Economy News (9 Aug 2020)

The energy sector led the market lower after the mining company Rio Tinto shot down rumours it was planning to restart an aluminium production line closed earlier this year.

It was reported the line may be restarted as soon as September, prompting speculation the Tiwai Point aluminium smelter may remain open beyond its planned closure in August 2021.

Contact Energy is up nearly 4.5%

Just Life Group, which supplies water coolers, announced an increase in unaudited profit before tax of $3.9m for the year ending June 30, compared with $2.6m last year. Its share price increased by 10%. They used to sell mainly water but now it also does home ventilation and skylights.

What are your thoughts about this company?

Turners & Growers Global Fresh produce exporter & importer Turners & Growers Global (T&G) posted strong growth figures in its first half of 2020. The stock price closed up 7.7% after a hefty amount of market reaction. Revenue was up by nearly 20% to $671 million, and net profit after tax was $9.5 million, more than double the previous first half's figure.

The positive result from T&G is interesting to compare to Scales, who operates in a very similar fashion and had far less positive results out this week.

T&G credits its success to a decision to ship apples early in the season to Europe and the UK, bypassing the logistical issues present during the Covid-19.

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

🔔 Subscribe on YouTube so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw...

🏡 Facebook Page - https://www.facebook.com/MaximShersto...

👉 Instagram - https://www.instagram.com/maxim.shers...

🎙 Subscribe to the Podcast

👉 LinkedIn - https://www.linkedin.com/in/maximsher...

📥 Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

4 U.S. Stocks to Buy Today (And Economic Update Aug 2020)

Although global unemployment has risen to alarming levels, household incomes have remained largely intact owing to substantial government response measures.

Global central banks are supporting government spending by keeping interest rates extremely low, buying financial assets (quantitative easing) and thereby facilitating increased government borrowing.

Consumers initially saved, but very quickly the income support from governments prompted spending. Unsurprisingly, much of this spending was online – US online sales have surged 30% compared to a year ago.

Changes in consumer spending patterns have benefitted a small handful of high-profile stocks, for example Amazon, Apple and Google.

Growth starved investors have bought these company shares, pushing prices to all-time highs.

Quarterly profits announced by the four tech giants (Microsoft, Apple, Alphabet and Amazon) in July exceeded even optimistic investors’ expectations, demonstrating their dominance in this environment.

The NZ share market was negatively impacted in July by the announcement of the closure of the Tiwai aluminium smelter, sending utility company shares lower.

The Australian share market underperformed last month, likely due to the resurgence of COVID-19 cases in Victoria, tensions with China and a strong Australian dollar making shares look expensive to offshore investors.

Looking ahead, there are several catalysts on the horizon. Company earnings will be released in Australia and NZ in August, revealing how well local companies have fared recently, and view their outlook over the next period of economic disruption.

Upcoming elections will come into focus in NZ and a couple of months later in the US. Given the significant role government policy has played in supporting the global economy, these elections will complicate the medium-term transition from government life support to an economy that can get back on its own two feet.

Markets have outperformed our expectations over the past few months, but uncertainty remains high.

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

🔔 Subscribe on YouTube so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

🏡 Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

👉 Instagram - https://www.instagram.com/maxim.sherstobitov/

🎙 Subscribe to the Podcast

👉 LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

📥 Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

3 Signs You Are Entering Stock Market Bubble Territory

In the midst of a recession, country-wide lockdowns and with the growing pandemic, there's no reason for the markets to be performing as well as they have been in recent months.

Are we heading toward a bursting asset bubble? Business Editor Liam Dann talks to Pie Funds CEO Mike Taylor.

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

🔔 Subscribe now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

👍 Like the video, if you want to see more of this kind of content

💬 Comment below - I read every single one!

🏡 Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

👉 Instagram - https://www.instagram.com/maxim.sherstobitov/

🎙 Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

👉 LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

📥 Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

Economy / NZX Stock Market 30-Day Review & News (2 Aug 2020)

Mainfreight shares hit a record $46.95 in early trading following a strong update and upbeat annual meeting. The shares rose 19% this month, valuing the business at $4.7 billion.

Jarden analysts said the result was "remarkable" and upgraded their forecast for net profit in the March 2021 year by 25%, due to increasing revenue in Australia and NZ.

Mainfreight reported growth in revenue of 5% and profit before tax growth of 18% for the first 4 months of this financial year which covered the lockdown.

The only downside to the update was the reduction in revenue growth in the Americas.

Pacific Edge rose a further 177%, extending an ongoing surge which has seen it gain more than 525% year to date.

Recently ANZ’s funds management arm bought $22 million of new shares in Pacific Edge, not long after the company was approved to provide services under the United States' national health insurance schemes.

The market is continuing to get its head around the market size in the US and what the potential income streams could be.

Marketing tech specialist Plexure announced it is looking at changing its primary listing to the ASX to have better access to capital. Shares rose 59%.

Communications and power infrastructure company ikeGPS said it will raise almost $20 million of new equity after winning one of the largest communications infrastructure companies in the United States as a customer.

It will also use the money for potential growth opportunities and take on new staff.

ikeGPS up 24%after its institutional placement closed oversubscribed.

Existing shareholders can subscribe for one share for every seven they own. New shares will be issued at a price of $0.68 a share, which represents a 11.7% discount to the last closing price of $0.77.

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

🔔 Subscribe now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

💬 Leave a review - I read every comment!

🏡 Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

👉 Instagram - https://www.instagram.com/maxim.sherstobitov/

🎙 Subscribe to this Podcast

👉 LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

📥 Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

8 Mistakes You Make During Pandemic and How to Avoid Them

Martin Hawes, Authorised Financial Adviser and author, will share with us the 8 things we have learned about economies and stock markets that you should never forget.

👇 Click SHOW MORE to read the rest 👇

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

🔔 Subscribe now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

👍 Like the video, if you want to see more of this kind of content

💬 Comment below - I read every comment!

🏡 Facebook Page - https://www.facebook.com/MaximSherstobitovPage/

👉 Instagram - https://www.instagram.com/maxim.sherstobitov/

🎙 Subscribe to the Podcast https://anchor.fm/maximsherstobitov/

👉 LinkedIn - https://www.linkedin.com/in/maximsherstobitov/

📥 Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

NZX Stock Market Weekly News & Review (26 July 2020) - Webinar Replay

Z Energy rose 7.66% because it increased the market share. The first quarter results for their 2021 financial year, although poor compared to last year, were above market expectations.

The report covered Z's performance between March 31 and June 30, encompassing most of the alert level 4 lockdown.

Total revenue was $594 million, down 53 per cent from last year's $1257m. This was primarily because lockdown reduced fuel sales by 39 per cent.

As expected, jet fuel was hit the hardest: volumes were 53 per cent lower than last year. Volumes in the less-impacted diesel sector dropped by 19.5 per cent, and petrol volumes were down 40.8 per cent. Cost-saving procedures meant Z's statutory loss for the quarter was limited to $49m.

Pacific Edge gained 23.1% after ANZ New Zealand Investments bought $22 million of new shares at a 14% premium. The stock is up 475% year-to-date and may be next in line to join the index.

Cavalier Corp rose 28.57%. The wool and carpet company said stock levels had decreased "significantly" to about $35 million, on the back of "stronger than anticipated" trading through June, particularly in wool sales.

Cannasouth went up 12.12% after announcing a new joint venture with Vera Cultivation, a Colorado-based, market-leading cannabis producer.

Vera will help Cannasouth design their cultivation facility, develop licensed operating systems and procedures, and provide support for implementation of growing facilities over the next 30 months.

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

🔔 Subscribe now so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw...

👍 Leave a podcast review - I read every comment!

🏡 Facebook Page - https://www.facebook.com/MaximShersto...

👉 Instagram - https://www.instagram.com/maxim.shers...

🎙 Subscribe to this Podcast

👉 LinkedIn - https://www.linkedin.com/in/maximsher...

📥 Join my exclusive weekly newsletter http://eepurl.com/gcmTU9

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and we cannot be held liable for any acts or omissions that arise from your use.

- Everything on this channel is for educational purposes only. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

Forecasting NZ Asset Prices & Study of Behavioral Economics

You are dealing with change in human behaviour, disruption to supply chains, and new government support measures. There is nothing worse than being unsure about the future. The correct information will help you invest successfully and minimise risks.

That’s why some of us are digesting media like never before and absorbing the extensive research that experts are providing.

This webinar will tell you how Jarrod Kerr, Kiwibank’s economist is seeing the future.

Do you agree with his predictions?

👉🏻 Learn other tips on the website https://www.MaximSherstobitov.NZ/

🔔 Subscribe now, so you do not miss the next show.

📊 Join a FREE NZX Stock Market Investors Facebook community - https://www.facebook.com/groups/NZXStockMarketInvestors

👥 Join a FREE Auckland Property Owners | Landlords | Investors community on Facebook - https://www.facebook.com/groups/AKLPropertyInvestors/

📈 Join ASX Stock Market Investors Facebook Community - https://www.facebook.com/groups/ASXStockMarketInvestors

IMPORTANT:

- The information does not constitute financial, accounting, legal or other professional advice and the owner of this channel cannot be held liable for any acts or omissions that arise from your use.

- Everything you hear and see on this channel is of general nature. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

Post COVID: Immigration, NZ Tourism, Economy, Stock Market

Martin Hawes, AFA, will talk with Shamubeel Eaqub, economist and author, about where COVID will take you in the next year and what the implications for investment will be.

👉🏻 Learn other tips on the website https://www.MaximSherstobitov.NZ/

🔔 Subscribe now, so you do not miss the next show.

📊 Join a FREE NZX Stock Market Investors Facebook community - https://www.facebook.com/groups/NZXStockMarketInvestors

👥 Join a FREE Auckland Property Owners | Landlords | Investors community on Facebook - https://www.facebook.com/groups/AKLPropertyInvestors/

📈 Join ASX Stock Market Investors Facebook Community - https://www.facebook.com/groups/ASXStockMarketInvestors

IMPORTANT:

- The information does not constitute financial, accounting, legal or other professional advice and the owner of this channel cannot be held liable for any acts or omissions that arise from your use.

- Everything you hear and see on this channel is of general nature. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

Interview Lewis Gradon, CEO Fisher & Paykel Healthcare (FPH)

F&P Healthcare has always been an "expensive" share — as characterised by a high price:earnings ratio (P/E) that in recent years has been around the 40:1 mark.

Right now it's much higher: at the current share price of $35.70 and earnings per share (from the latest 2020 results) of $0.50, that means investors are paying a mammoth $71.40 for every $1 that F&P earns.

There's a lot of good that F&P's management have done to create its growth momentum. But like everyone, the company is also susceptible to shocks (positive or negative) outside its control.

Fisher & Paykel has benefited from the sudden unexpected demand for its products caused by a global pandemic that most would not have predicted a year ago.

On the flip side, its investors may suffer in future should global economic growth resume and competition for funds pushes up interest rates (unlikely as that might seem right now).

PERFORMANCE

29 June 2020 - Fisher & Paykel Healthcare Corporation Limited announced its results for the full year ended 31 March 2020.

Operating revenue was $1.26 billion, up 18% over last year, or 14% in constant currency.

Overview of key results for the 2020 financial year:

- 37% growth in net profit after tax to a record $287.3 million.

- 18% growth in operating revenue to a record $1.26 billion, 14% growth in constant currency.

- 25% growth in Hospital operating revenue, 21% growth in constant currency.

- 23% constant currency revenue growth for new applications consumables; i.e. products used in non-invasive ventilation, Optiflow nasal high flow therapy, and surgical applications, accounting for 64% of Hospital consumables revenue.

- 9% growth in Homecare operating revenue, 4% growth in constant currency.

- 4% growth in constant currency revenue in OSA masks.

- Investment in R&D was 9% of revenue, or $118.5 million.

- 15% increase in final dividend to 15.5 cps (2019: 13.5 cps).

Excluding the impact from tax changes, being the R&D tax credit and building tax depreciation, net profit after tax grew 23% in constant currency.

The increase in revenue was largely driven by growth in the use of the company's OptiflowTM nasal high flow therapy, demand for products to treat COVID-19 patients, and strong hospital hardware sales throughout the course of the year.

"The 2020 financial year was already on track to deliver strong growth before the coronavirus impacted sales," said Managing Director and CEO Lewis Gradon.

"Beginning in January, the demand for our respiratory humidifiers accelerated in a way that has been unprecedented."

👉🏻 Learn other tips on the website https://www.MaximSherstobitov.NZ/

🔔 Subscribe now, so you do not miss the next show.

📊 Join a FREE NZX Stock Market Investors Facebook community - https://www.facebook.com/groups/NZXStockMarketInvestors

👥 Join a FREE Auckland Property Owners | Landlords | Investors community on Facebook - https://www.facebook.com/groups/AKLPropertyInvestors/

📈 Join ASX Stock Market Investors Facebook Community - https://www.facebook.com/groups/ASXStockMarketInvestors

IMPORTANT:

- The information does not constitute financial, accounting, legal or other professional advice and the owner of this channel cannot be held liable for any acts or omissions that arise from your use.

- Everything you hear and see on this channel is of general nature. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

NZ Real Estate & Stock Market Outlook 2020 + Q & A

As New Zealand emerges from lockdown, you may be left wondering what this crisis means for your financial situation. Whether you are a property owner or an NZX stock market investor, it’s helpful to understand how COVID-19 will impact your future.

This webinar is presented by Quinovic Property Management and Shamubeel Eaqub who is a renowned New Zealand economist.

- All slides can be accessed on YouTube here https://youtu.be/ipkdJO5Vnp0

You will gain valuable insights on the post-pandemic market and learn about the proactive steps you can take to better protect your circumstances in these rapidly changing times.

With over a decade of experience, Shamubeel Eaqub is known for making economics easy. This discussion is bound to offer helpful advice and some key considerations for new or experienced investors.

Shamubeel has worked in various banks and consultancies in New Zealand and Australia. He currently balances a portfolio of activities: consulting through Sense Partners, a boutique economic consultancy; various governance and advisory roles for private firms and charities; and regular media contributor.

He holds a BCOM(Hons) in Economics from Lincoln University and is also a Chartered Financial Analyst. He has authored several books – the most recent are Generation Rent and Growing Apart. Shamubeel lives in Auckland with wife, Selena, and sons Haydn and Hugo.

👉🏻 Learn other tips at https://www.MaximSherstobitov.NZ/

✅ Subscribe to this podcast

🔔 Subscribe to the YouTube show, so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

🏡 Join Auckland Property Owners Facebook Community - https://www.facebook.com/groups/AKLPropertyInvestors

📊 Join NZX Stock Market Investors Facebook Community https://www.facebook.com/groups/NZXStockMarketInvestors

📈 Join ASX Stock Market Investors Facebook Community - https://www.facebook.com/groups/ASXStockMarketInvestors

IMPORTANT:

- The information does not constitute financial, accounting, legal or other professional advice and the owner of this channel cannot be held liable for any acts or omissions that arise from your use.

- Everything you hear and see on this channel is of general nature. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

NZ Property & Economic Update - June 2020 by CoreLogic NZ

It looks like market activity is heading back to some sort of normality too with agent appraisals, new listings and bank ordered valuations in June comparing favourably to previous years.

In fact, new for sale listings for the last three weeks are tracking right in line with the average over the last 5 years.

Such normality during a time that’s anything but normal is actually comfortably reassuring. We’re not seeing a flood of properties coming to market stressed, yet vendors aren’t afraid to list their property for fear of uncertainty.

The market has certainly not gone through unscathed though as the Real Estate Institute’s data for May has shown.

Sales volumes in May remained well below previous years, but that’s not surprising given we were at alert level two or three for the entire month, with physical distancing practices still in place throughout.

When adjusting volumes for non-agent sales as well, we’re reporting a drop of almost 44% nationwide compared to last year, with both Wellington and Christchurch experiencing slightly better bounce-backs compared to the other main centres.

With the drop in sales volumes we need to be cautious of greater volatility in value measures, including house price indices, however for the main centres we can get a reasonable read of where things are at.

And there is now no doubt property values have been impacted by COVID-19. According to the REINZ house price index, nationwide values dropped by -0.5% in May and are -1.6% down over the last three months.

That three month measure is a decent barometer of market performance for those areas with a large enough sample of sales in May – typically the main centres – comparing the relative prices paid in May to back in February, before any uncertainty really hit the market.

The audio version of the webinar is presented by Head of Research, Nick Goodall from CoreLogic NZ.

👉🏻 Learn other tips on the website https://www.MaximSherstobitov.NZ/

🔔 Subscribe now, so you do not miss the next show.

📊 Join a FREE NZX Stock Market Investors Facebook community - https://www.facebook.com/groups/NZXStockMarketInvestors

👥 Join a FREE Auckland Property Owners | Landlords | Investors community on Facebook - https://www.facebook.com/groups/AKLPropertyInvestors/

📈 Join ASX Stock Market Investors Facebook Community - https://www.facebook.com/groups/ASXStockMarketInvestors

IMPORTANT:

- The information does not constitute financial, accounting, legal or other professional advice and the owner of this channel cannot be held liable for any acts or omissions that arise from your use.

- Everything you hear and see on this channel is of general nature. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

Investing for Beginners NZ (Funds, Stock Market, Property)

You will learn how to set aside money while you are busy with life and have that money work for you. This strategy applies no matter your age or how small your salary.

In this video you will discover tips on asset allocation, investing direct or funds, active or passive and our sell criteria etc

The audio version of the webinar is presented by Martin Hawes who is a registered financial adviser. If you have more questions, please contact https://martinhawes.com/

👉🏻 Learn other tips at https://www.MaximSherstobitov.NZ/

✅ Subscribe to this podcast

🔔 Subscribe to the YouTube show, so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

🏡 Join Auckland Property Owners Facebook Community - https://www.facebook.com/groups/AKLPropertyInvestors

📊 Join NZX Stock Market Investors Facebook Community https://www.facebook.com/groups/NZXStockMarketInvestors

📈 Join ASX Stock Market Investors Facebook Community - https://www.facebook.com/groups/ASXStockMarketInvestors

IMPORTANT:

- The information does not constitute financial, accounting, legal or other professional advice and the owner of this channel cannot be held liable for any acts or omissions that arise from your use.

- Everything you hear and see on this channel is of general nature. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

NZ Investment Trends After Coronavirus (5 Winners & Losers)

These emerging trends offer you signals of what people will value and their priorities in a post-COVID19 world. Are you prepared for these new behaviours? How can you take advantage?

Coronavirus has had far-reaching effects on more than just our health and workplace. How we interact, work, shop, learn and holiday has changed, and it is expected some of these changes will remain after a vaccine for the virus has been developed.

This episode is presented by Martin Hawes who is a registered financial adviser. If you have more questions, please contact https://martinhawes.com/

👉🏻 Learn other tips here https://www.MaximSherstobitov.NZ/

🔔 Subscribe now to the YouTube channel, so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

✅ Subscribe to this podcast

📊 Join NZX Stock Market Investors Facebook community - https://www.facebook.com/groups/NZXStockMarketInvestors

👥 Join Auckland Property Owners | Landlords | Investors community on Facebook - https://www.facebook.com/groups/AKLPropertyInvestors/

📈 Join ASX Stock Market Investors Facebook Community - https://www.facebook.com/groups/ASXStockMarketInvestors

IMPORTANT:

- The information does not constitute financial, accounting, legal or other professional advice and the owner of this channel cannot be held liable for any acts or omissions that arise from your use.

- Everything you hear and see on this channel is of general nature. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

Infratil Stock (IFT - NZX) Company Review & Outlook - June 2020

Infratil owns renewable energy, transport, data and connectivity, and social infrastructure businesses in growth sectors.

Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

As outlined in the Infratil FY2020 full year results announcement on 29 May 2020, given ongoing uncertainty over the duration and impact of the COVID-19 pandemic, Infratil will not be providing FY2021 Group earnings or dividend guidance at this stage.

This talk reviews Infratil with Tim Brown who is currently Chairman of partly owned Wellington Airport. You will learn how Infratil portfolio companies are navigating the challenges that come with COVID-19.

PERFORMANCE:

- Net surplus for the year from continuing operations of $508.8 million, compared to $64.4 million in the prior year

- 13.5% growth in underlying EBITDAF reflected changes in the portfolio and a growing contribution from data and communications infrastructure;

- Acquisition of 49.9% of Vodafone New Zealand completed on 31 July 2019 for $1.03 billion

- Divestments and tightening of the portfolio are now substantially complete

COVID-19’s IMPACT:

- Vodafone’s roaming revenue has been adversely impacted, and these effects will likely continue while COVID-19 related travel restrictions remain in place

- Infratil expects a slowdown in tax equity markets and corporate Power Purchase Agreements in FY2021 to impact the rate of new development at Longroad Energy

- Trustpower’s performance is likely to be impacted by a slowdown in demand for power and potential for lower average wholesale prices in FY2021 as well as the potential for lower cash collections from retail customers

- Wellington Airport’s performance is likely to be severely impacted by ongoing COVID-19 related travel restrictions and reduced passenger volumes

If you want to participate in the future interviews then join https://www.nzshareholders.co.nz

✅ Learn other tips at https://www.MaximSherstobitov.NZ/

🔔 Subscribe now to the YouTube channel, so you do not miss the next video ➜ https://www.youtube.com/channel/UCHIw-Ej9kivd77bavBCnatQ?sub_confirmation=1

💬 Leave a Comment - I read every comment!

🏡 Join Auckland Property Owners Facebook Community - https://www.facebook.com/groups/AKLPropertyInvestors

📊 Join NZX Stock Market Investors Facebook Community - https://www.facebook.com/groups/NZXStockMarketInvestors

📈 Join ASX Stock Market Investors Facebook Community - https://www.facebook.com/groups/ASXStockMarketInvestors

IMPORTANT:

- The information does not constitute financial, accounting, legal or other professional advice and the owner of this channel cannot be held liable for any acts or omissions that arise from your use.

- Everything you hear and see on this channel is of general nature. It does not take into account your investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

What I Learned Reading 30 Books on Money & Investing

If you want to retire early, you’re probably thinking about how much you’ll need, and how much you can safely take out each year. Watch these practical tips that you can apply today.

📚YOU WILL LEARN:

1) Must Read Books for You to Achieve Financial Freedom

2) The Rule of 25 and How 4% Safe Withdrawal Works

3) Simple, Actionable Steps that Can Increase Your Net Worth

👉🏻 Learn other tips on the website https://www.MaximSherstobitov.NZ/

🔔 Subscribe now, so you do not miss the next show.

📊 Join a FREE NZX Stock Market Investors Facebook community - https://www.facebook.com/groups/NZXStockMarketInvestors

👥 Join a FREE Auckland Property Owners | Landlords | Investors community on Facebook - https://www.facebook.com/groups/AKLPropertyInvestors/

IMPORTANT:

- The information does not constitute financial, accounting or legal advice and the owner of this channel cannot be held liable for any acts or omissions that arise from your use.

- This channel provides general information, not personalised advice. The information does not take into account any person's particular investment objectives, financial situation and personal needs.

- Past performance is not a guarantee of future returns. Before making any financial decisions, you should seek independent financial advice.

Live Debate: Passive Fund Managers vs Active Fund Managers