Riskgaming

By Lux Capital

RiskgamingApr 05, 2022

Margaret Mead and the psychedelic community that theorized AI

How does science progress? One way to look at the question is to peer into individual fields and observe the flow of ideas from laboratories and experiments into seminars and conferences and ultimately into the journal record. But the reality is so much more complicated since science is truly a creative act, a set of imaginative leaps from incumbent ways of thinking to new possibilities. The milieu that scientists inhabit — and particularly science’s most productive leaders — is often far more expansive than one would expect.

That’s the story today with Margaret Mead and the rise of psychedelic research. Best known as a cultural anthropologist, Mead spanned the sciences, from information theory into the humanities. That range brought her into regular contact with brilliance, and also helped her transmit vital ideas and concepts from field to field. One of the circles she participated in was an emerging group of scholars conceptualizing ideas around computer science, neurology and consciousness, linked together by a curiosity around psychedelics within the paranoia of Cold War politics.

Joining host Danny Crichton on the Riskgaming podcast today is Benjamin Breen, a professor of science at the University of California Santa Cruz who just published his new book, Tripping on Utopia: Margaret Mead, the Cold War, and the Troubled Birth of Psychedelic Science. Also joining me today is Lux Capital’s scientist in residence Sam Arbesman.

We cover Margaret Mead’s early work, her popularization of science, the Macy conference circles that brought disparate networks of scientists together in New York City, the utopian dream of science in the 1920s and 1930s recently depicted in Christopher Nolan’s Oppenheimer movie, the rise of LSD and finally, why there were so many interconnections between these scientists and defense institutions like the CIA.

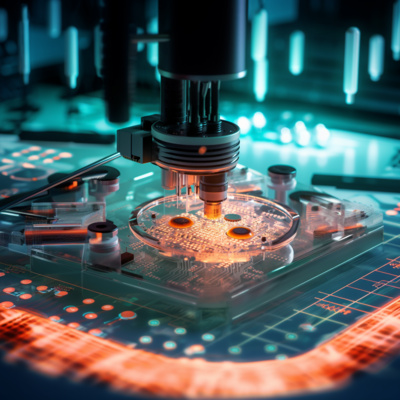

The nightmare specter of designer bioweapons and the people trying to stop them

Ever since the invention of CRISPR technology about a decade ago, biologists have gained increasing power to discover new DNA sequences, cut and mash them up, and then print them in ever larger volumes through biomanufacturers. That freedom and openness is the opening to a long-awaited Century of Bio, with scientists bullish on the potential to discover cures to long-resistant diseases.

On the tails side of the coin though, there are fears that the open nature of these tools afford a rebel scientist the means of inventing and distributing well-known or completely novel pathogens that could threaten the lives of millions. It’s not the premise for a bad Hollywood B-movie, but a top security threat that experts at the White House and in the intelligence and defense communities are rapidly trying to solve.

Today, I have Kevin Flyangolts of Aclid joining us. Aclid is using artificial intelligence to identify what new sequences of DNA might do, scaling up screening efforts that might allow biomanufacturers the ability to verify their customers’ intentions in a more thoughtful and comprehensive way.

Kevin and host Danny Crichton talk about the recent history of bio, the rise of biohacking, the differences between bioweapons, cyberweapons and financial crimes, why we need new approaches to biosecurity, whether executive, legislative or industry approaches might work best, and whether designer bioweapons are as dangerous as many are making them out to be.

Finally, a note: in line with the launch of our first riskgaming scenario on the Lux Capital website, Hampton at the Cross-Roads, we have officially condensed the “Securities” podcast name into just “Riskgaming,” which I think captures in one word the risks and opportunities that come from science, technology, finance and the human condition. Same show, more focused name and a great future.

Lux and the Art of Startup Maintenance

Every quarter, Lux publishes our latest quarterly letter to our limited partners, highlighting the key themes we’re working on as a partnership. These topics are — unsurprisingly — bold, as the frontiers of science fiction transition into the world of the possible. But this time around, we’re emphasizing a new thesis that we think combines the future and the past, and might just help the entire world to boot.

Lux co-founder and managing partner Josh Wolfe joins host Danny Crichton to discuss Lux’s new theme of “maintenance.” As Josh wrote, “Maintenance is not about preserving the status quo but thoughtfully fueling forward progress by improving on humanity’s past achievements.” Josh discusses the opportunity with maintenance, as well as why the repair of our society and its infrastructure is a growth industry since “the value of maintaining existing systems grows as entropy accelerates, and as we reach the Entropic Apex, that value becomes concomitantly unbounded.”

The Zone of Totality with Sam Arbesman

This week’s solar eclipse captured the imaginations of millions of Americans throughout an arc across the continent. One of those entranced was Sam Arbesman, Lux’s scientist-in-residence and a local of Cleveland, which sat in the full zone of totality. Sam also happened to live in Kansas City during the 2017 eclipse, so he has (accidentally) eclipsed-chased in his choices of residence.

Briefly, Sam and host Danny Crichton talk about the eclipse, the mesmerizing impact of science, and the unique community that comes together in cities lying in the darkness. Lux is “light” in Latin, and so what happens when darkness descends across the Earth? Surprisingly, something magical and optimistic, showing how science and mathematics has the ability to transmute our passions into something great.

Biology is becoming engineering and not just science

During a recent interview, Nvidia CEO Jensen Huang emphasized his interest in how Nvidia’s AI processing chips could transform the science of life. He noted that this science, when properly understood, could evolve into a new form of engineering. Currently though, we lack the knowledge of how the extreme complexity of biology works, nor do we have models — namely AI models — to process that complexity.

We may not have a perfect understanding of biology, but our toolset has expanded dramatically over the past ten years. Now, with the combination of data, biology and AI, we’re seeing the early signs of a golden era of biological progress, with large-language models that are able to predict everything from protein folding to increasingly, protein function. Entire spaces of our map are being discovered and filled in, and that is leading to some bullish scientists and investors to call the period we are living in the century of biology. But much remains to be done, and that’s the topic of our episode today.

Host Danny Crichton is joined by Lux Capital’s bio investor Tess van Stekelenburg. Tess and Danny talk about Nvidia’s recent forays into biology as well as the new foundational model Evo from the Arc Institute. They then look at what new datasets are entering biology and where the gaps remain in our global quest to engineer life. Finally, they’ll project forward on where evolution might be taking us in the future once unshackled by nature.

The three revolutions in astrobiology and the search for extraterrestrial life

Astrobiology has seen a series of revolutions over the past three decades that have completely reinvigorated the field. Scientists who were curious about life and biological organisms across the universe once had to handle the so-called giggle factor: the idea that they were kooky crazies searching for UFOs and little green men. With a dramatic improvement to the quality of our instruments and a torrent of new and better data, that giggle factor is now no laughing matter: we increasingly have the means to make progress here like never before.

My guest today is Adam Frank, the author of The Little Book of Aliens and a professor of astrophysics who is focused on improving our ability to identify biosignatures and technosignatures of life throughout the cosmos. He’s just one contributor to a growing community of scientists reinventing our approach to the search for life, a vitality that is leading to the potential first dedicated satellite focused on the search, the Habitable Worlds Observatory.

Alongside host Danny Crichton and Lux’s scientist in residence Sam Arbesman, we talk about the trilogy of revolutions that have brought new vigor to astrobiology, how artificial intelligence is upending the search for life, and what we can also learn about Earth and our climate in searching space for the answers of life.

“I am basically a cosmic Fluke” and the chaos of science, policy, and human narratives

Humans are enamored by a good story. The world overloads our mammalian senses, and so we seek any simplifying structure to narrate what we are witnessing and make it more accessible for processing. That simplification doesn’t just reduce the complexity of the world, but also makes it difficult to see the extent by which luck drives the successes of our geniuses — and the failures of others. From scientific discoveries and power-law venture returns to legislative breakthroughs and decisions during war, the world is, essentially, chaos.

That might trigger a bout of deep existentialism for many of us, but for Brian Klaas, the hope is that confronting the stochastic nature of the world can lead to better governance and progress. In his new book Fluke, Klaas argues that we need to upend the simplistic statistical analyses and modeling that are common across social science and other domains and replace it with one that can encompass a theory of flukes. That means understanding timing, path dependency, and how the world is a complex system that is far more of a continuous variable than a binary one.

With Lux’s scientist-in-residence Sam Arbesman and host Danny Crichton, we all talk about how chaos rules our lives; how a better understanding of complexity can improve investments, science, and life; Darwin’s luck of publishing his research on natural selection; the dangers of the human penchant for finding narrative; the random luck of our life experiences; and why understanding flukes can be a counterpoint to the ideas of moneyball.

How an anonymous blog during the neural network winter led to Japan’s national AI champion

Connections are the key ingredient for careers, society and AI neural networks to boot. Sometimes those connections arise spontaneously and other times they’re planned, but the most interesting ones tend to be planned that go in unexpected directions. That’s the story of David Ha, the co-founder and CEO of Sakana, a world-class generative AI research lab in Tokyo, Japan.

We previously announced that Lux led a $30 million founding seed round in the company a few weeks ago on the podcast, but we didn’t dive deeper into the ricochets of David’s peripatetic career. Studying computer science and machine learning at the University of Toronto, he worked down the hall from now-famous AI researcher Geoffrey Hinton. He ultimately headed to Goldman Sachs in Tokyo doing derivatives trading, but on the side, he published a shadow and anonymous blog where he posted random experiments in artificial intelligence. A decade later of serendipitous connections later, and he is now leading one of the emerging national AI leaders for Japan.

We talk through the stochastic moments that defined David’s career, why complex systems knowledge would ultimately turn out to be so valuable, the unique features and benefits of Japan, why openly communicating ideas and particularly interactive demos can spawn such serendipitous connections, why industry has produced more innovation in AI than academia, and why Google’s creativity should never be discounted.

The most wasteful infrastructure megaproject that wasn’t

The construction of Boston’s Big Dig highway tunnels has gone down in history as one of the most infamously delayed and over-budgeted infrastructure projects in the sorry annals of U.S. growth and progress. But Ian Coss sees the project radically different. In hindsight, he argues, the Big Dig was a steal: the good kind. Far from being a gargantuan boondoggle, the project resuscitated downtown Boston and ushered in urban economic benefits and spillovers that dwarf the costs of the project, however one might calculate them.

Ian interviewed more than 100 people connected with the Big Dig and spent months editing a nine-episode podcast series titled “The Big Dig” for GBH News, Boston’s National Public Radio affiliate. Through the series, he covers everything from the environmental consciousness of the 1960s and colorful yet idealistic local political figures to the Department of Transportation’s inflation estimate policy and ultimately the decades it took to bring the dream of burying Boston’s unsightly Central Artery freeway.

On today’s “Securities” podcast with host Danny Crichton, Danny and Ian debate the merits of the Big Dig megaproject, the complicated construction policies that made the project seem like a loser in front of the public, and just how hard it is to measure the true impact of a project that forever transformed one of America’s founding cities.

The stove hasn’t changed in decades. It’s time to upgrade.

Home appliances are some of our most used and time-saving technologies, but they have barely evolved since their invention. A “smart” movement from major manufacturers tried to upgrade them with random tech features over the past decade, only to frustrate consumers with random crashes and mandatory web updates for a fridge. It was the nadir of user-friendly design and an embarrassing example of tech for tech’s sake.

Impulse Labs wants to improve this miserable status quo. Funded by Lux, Impulse is rethinking appliances from the foundations up, evolving the experience of home appliances for the twenty-first century. What if our stoves could boil water all but instantly? What if we could perfectly and effortlessly cook a steak — every single time. And what if we could do all this while transforming the power grid and the availability of decentralized electricity for ourselves and our neighbors?

That’s just part of the vision of Impulse Labs founder and CEO Sam D’Amico. Sam and host Danny Crichton talk about hardware product design, consumer marketing, what it takes to build the right supply chains as well as standing out during the chaos that is CES in Las Vegas.

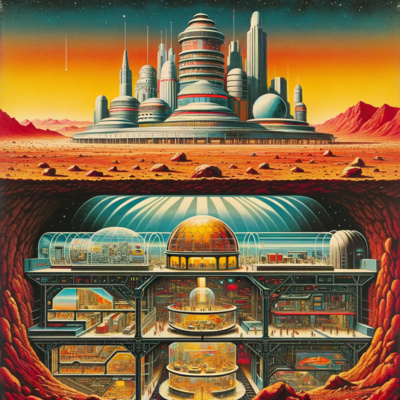

Astronauts all lie, but the biggest lie is that we will colonize Mars (Zach Weinersmith, Part 1 of 2)

Colonizing Mars has gone from the speculative fiction section of the bookstore right into the halls of Congress. Entrepreneurs led by Elon Musk have made “Occupy Mars” a tagline, and companies the Earth over are exploring the logistics of settling humans across the Moon and Mars. But what’s the true viability of a Mars settlement plan? Do we have the technology and legal systems in place to make this one-time fiction a reality?

Popular cartoonist and author, Zach Weinersmith, wrote “A City On Mars” alongside his wife Kelly Weinersmith to explore that very question. Starting with an optimistic lens, they eventually conceded in the book that the project is one of extraordinary difficulty and are pessimistic at its chances. “A City On Mars” won a slew of best-of awards in 2023 for its delightfully engaging and humorous breakdown of complex physical and biological topics.

In this first part of a two-part series, host Danny Crichton and Lux’s scientist in residence Sam Arbesman discuss with Zach the biological and psychological challenges of inter-planetary settlement and why every astronaut lies about their health in outer space. We also explore the challenges of reproduction in space, and what a second generation of settlers might have to endure in the far reaches of our solar system.

Music composed by https://www.georgeko.co/ "Securities" is produced and edited

Why a Mars settlement could never be a libertarian paradise (Zach Weinersmith, Part 2 of 2)

The current drive for a Mars colony revolves around two central axes: one is a fear of existential risk and the other is a search for existentialism. On the former, philosophers and probabilists remain deeply concerned about humanity’s Achilles heel: that our entire existence depends on the sustenance of a single blue dot in the Milky Way. Humanity’s fate is fundamentally tied to this single rock, which gives little redundancy from an asteroid strike, nuclear winter, or pandemic.

At the same time, many entrepreneurs hear a rallying cry when they think about a Mars colony, arguing that a bold and long-term project is precisely what is needed to galvanize humanity to work together, overlook our internecine differences and find transcendence amidst the celestial cosmos. Even if outside our lifetime, a drive toward a space colony could be an existentialism that offers meaning and sustenance to our lives.

In this second and final episode, Zack Weinersmith, who along with his wife Kelly Weinersmith are the authorial duo of A City on Mars, join host Danny Crichton and Lux’s scientist-in-residence Sam Arbesman to talk more about their negative prognostication for a Mars colony. Taking a more optimistic view, we also talk with Zach about what we should be doing to prep for a colony, including collecting more laboratory data and expanding science’s understanding of life under microgravity conditions.

How Impulse Space’s Helios will democratize access to Earth’s farthest orbits

The cost of launching a payload into low-earth orbit has shrunk dramatically over the past two decades as SpaceX has aggressively expanded its capability to repeatedly launch payloads into orbit at cheap cost. But accessing orbits farther away from Earth, such as Medium Earth orbit (MEO) and Geostationary orbit (GEO), remain expensive endeavors.

Lux’s portfolio company Impulse Space, which is building the next generation of rocket propulsion for space, unveiled the design specs of its new high performance kick stage vehicle Helios today. The vehicle will allow operators to move objects like satellites from Low Earth orbit to orbits farther away at just a fraction of today’s costs, and it’s coming soon in 2026.

I talked with Impulse Space’s CEO and founder Tom Mueller about Helios, as well as the growing concerns over space junk, a recent satellite emergency over Christmas, the television show The Expanse, space traffic control and what it means to move things in space and bring them back home.

Why Tokyo’s Sakana AI is pioneering a new vanguard of national AI foundation models

Lux announced big news today: we are leading a $30 million founding seed round into Sakana AI, a Tokyo, Japan-based AI research laboratory that uses evolutionary methods, collective intelligence and character-level training to radically accelerate the training and development of nature-inspired AI foundation models. It’s a marquee check for Lux into the Asia-Pacific region, and represents the continuing democratization of the frontiers of computer science to all regions of the world, a trend we’ve championed for years now.

I, your host Danny Crichton, wanted to spend some time on the economic and technological milieu that is changing the face of startups and entrepreneurship globally in 2024. In this episode, I walk through three themes that are driving Lux’s interest in Sakana AI and other companies, including the rise of national and indigenous AI foundation models, the return of Japan’s dynamic economy after decades of stagnation, and the broader ambitions of the Asia-Pacific region as China recedes from the minds of international investors in the midst of President Xi Jinping’s crackdown on private entrepreneurship.

Music composed by https://www.georgeko.co/ "Securities" is produced and edited by Chris Gates

WTF Happened in AI in 2023?

Hey, it's Danny Crichton. 2023 was an incredibly busy year, and nowhere was there more fervent attention than on artificial intelligence. OpenAI launched ChatGPT at the very end of 2022, and its implications found purchase this year among more than one hundred million users and the regulators who serve them. Those product developments don't even get into the crazy governance crisis at OpenAI a few weeks ago, which saw Sam Altman and then the board of directors toppled in a story that likely outshone the collapse of Silicon Valley Bank as the most important tech crisis of the year. Billions of dollars of venture capital flowed into the AI space, with investors funding everything from data infrastructure and better model training to the applications that are already beginning to transform industries across the world. Governments have moved with alacrity to regulate this new technology, but progress is unabated and unstoppable. The "Securities" podcast has aggressively covered these developments throughout 2023, with interviews with more than a dozen experts in all facets of this new technology, from the corporate executives building these products and the generals using these new features for American defense, to the critics who caustically analyze AI's supposed truthful implications and the philosophers debating the theory of mind and consciousness of these systems. So as the final episode of the podcast this year, I wanted to connect all of these separate discourses around artificial intelligence together into one cohesive package. We clipped nine of the best segments from episodes across 2023 — special thanks to our producer Chris Gates on finding these treasures. A retrospective, an incitement to innovation, a warning — it's all here, so let's get started.

This episode was produced, recorded and edited by Chris Gates

Music by George Ko

Eliot Peper's new novel 'Foundry' and the Future

In a world where science fiction often paints a pessimistic picture of dystopian futures and critiques of modern technology, novelist Eliot Peper stands out with his latest work, "Foundry." a thrilling exploration of the geopolitical intricacies of semiconductor manufacturing. In this episode of the "Securities" podcast, host Danny Crichton engages with Peper to discuss this engaging spy thriller, which goes beyond the surface to delve into how the tiny chips powering our phones and computers play a central role in 21st-century global politics. This book, Peper's 11th, began with a dream and unfolded line by line, leading to an unexpected journey through the complex realities of technological advancements and their impact on world affairs. "Foundry" is more than just a story; it's an invitation to ponder the unseen forces shaping our civilization.

While semiconductors are a key topic, the conversation goes deeper, examining why Eliot continues to weave narratives in speculative fiction amidst a tech industry often bogged down by the weight of relentless pessimism.

Erik Hoel (part 2): Dreaming, AI, and the Future of Education

Ever wonder if your dreams were more than just dreams? Dive into an intriguing conversation with Erik Hoel on our latest “Securities” podcast with host Danny Crichton, as we explore the unexpected link between AI, neuroscience, and the enigmatic world of dreams.

What if dreams are our brain's way of preventing cognitive overfitting, much like synthetic datasets in machine learning? Could dreams be the human equivalent of synthetic data?

This episode doesn't just stop at dreams. We end the conversation with a discussion of Erik’s essay “Why we stopped making Einsteins” delves into the intriguing question of why, despite the widespread availability of knowledge through the internet, there hasn't been a noticeable surge in the emergence of geniuses or a new golden age of intellectualism. Hoel argues that the decline in the production of geniuses, or world-historic figures, is closely tied to changes in education, particularly the decline in personalized, one-on-one tutoring.

Could AI be the revival in one-on-one tutoring that we need to unlock genius?

With engaging insights from guests Josh Wolfe and Samuel Arbesman. Don't miss this captivating episode that merges the mysterious with the scientific, offering a fresh perspective on the wonders of the human mind and the future of AI. Tune in and be part of a discussion that's reshaping our understanding of consciousness.

Erik Hoel (part 1): The Consciousness Winter

In this episode of the "Securities" podcast, host Danny Crichton leads a discussion on consciousness with guests Erik Hoel, Josh Wolfe, and Samuel Arbesman. They dive into "The Consciousness Winter," comparing it to the AI winter in artificial intelligence. This concept highlights how consciousness studies were once sidelined but have since seen a revival. The conversation covers various theories, including Integrated Information Theory (IIT), and the importance of a mathematical approach to understanding consciousness.

Techno-Pragmatism: Looking Beyond Blind Optimism and Hopeless Pessimism

Welcome to "Securities," a podcast and newsletter about science, technology, finance, and the human condition.

In this episode, Danny Crichton and Josh Wolfe discuss themes from Lux Capital's Quarterly Letter, where techno-optimism collides with the despair of techno-pessimism.

The conversation dives into the paradoxes of AI, oscillating between its awe-inspiring potential in transforming healthcare and education and the looming existential threats it poses. Danny and Josh dissect the complexities of AI, debating whether it's a Pandora's box leading humanity towards an unstoppable dystopian future or a beacon of hope promising unprecedented societal benefits.

They also look at the critical role of error correction and criticism in the advancement of technology, advocating for a pragmatic middle ground in a world polarized between blind optimism and hopeless pessimism. The duo explores the necessity of competitive open systems in fostering innovation, warning against the dangers of AI monopolies.

Josh sheds light on the concept of instrumental objectivity, emphasizing the urgent need for realism and pragmatism in technological and societal progress. They argue that while we aim for lofty future goals, the focus should remain on developing practical tools and instruments in the present.

It's a must-listen for anyone interested in the future of AI, the role of innovation in society, and the fine line between utopian dreams and apocalyptic realities.

AI: Disruption, Regulation, and the Road Ahead

In this episode of “Securities” by Lux Capital, host Danny Crichton joins guests Brian McCullough, host of the Techmeme Ride Home podcast and General Partner at the Ride Home Fund; Shahin Farshchi, General Partner at Lux Capital; and Matthew Lynley, founder and writer of the Supervised newsletter to discuss regulation and competition in AI, questioning whether open-source or proprietary AI will dominate the future. With discussions ranging from the impact of large language models to AI’s encroachment on government agendas, this episode touches upon the battles shaping AI’s future. Are we on the brink of an AI utopia or a dystopia? This episode is a crucial listen for anyone wanting a snapshot of AI’s as it stands today.

Navigating the Crossroads: Technology, Democracy, and National Security with Miles Taylor

Welcome to this enlightening episode of "Securities” Podcast with host Danny Crichton, where we navigate the intricate crossroads of technology, national security, and democracy. Our guest today is Miles Taylor, the author of "Blowback: A Warning to Save Democracy from the Next Trump."

In this episode, we delve deep into the challenges and complexities of modern governance, the shifting landscape of national security threats, and the role of technology in shaping our society. We explore the impact of generative AI on the creative class and ponder the future of democracy in an increasingly digital world.

Join us for a thought-provoking discussion that will leave you questioning the trajectory of the United States, its people, and where things are headed in this age of rapid technological advancement.

Lt. Gen. Jack Shanahan on rebuilding trust between Silicon Valley and the Pentagon

As the birthplace of semiconductors and computers, Silicon Valley has historically been a major center of the defense industry. That changed with the Vietnam War, when antiwar protesters burned down computing centers at multiple universities to oppose the effort in Southeast Asia, as well as the rise of countercultural entrepreneurs who largely determined the direction of the internet age.

Today, there are once again growing ties between tech companies and the Pentagon as the need for more sophisticated AI tools for defense becomes paramount. But as controversies like Google’s launch of Project Maven attest, there remains a wide chasm of distrust between many software engineers and the Pentagon’s goals for a robust defense of the American homeland.

In this episode of “Securities”, host Danny Crichton and Lux founder and managing partner Josh Wolfe sit down with retired lieutenant general Jack Shanahan to talk about rebuilding the trust needed between these two sides. Before retirement, Shanahan was the inaugural director of the Pentagon’s Joint Artificial Intelligence Center, a hub for connecting frontier AI tech into all aspects of the Defense Department’s operations.

We talk about the case of Project Maven and its longer-term implications, the ethical issues that lie at the heart of AI technologies in war and defense, as well as some of the lessons learned from Russia’s invasion of Ukraine the past year.

Simulating Evolution: Playing God or the Next Frontier?

Artificial life, aka “A-life”, is an intellectually vital field simulating life within computational systems. By allowing simulations to run uninterrupted for extended periods, researchers can observe emergent behaviors, patterns, and even evolutionary trajectories. What's particularly intriguing is that these artificial systems often exhibit behaviors and patterns reminiscent of natural life, reinforcing that certain principles of life and evolution might be universal, whether in a biological context or a digital one.

In this episode of "Securities," host Danny Crichton is joined by Lux scientist-in-residence Sam Arbesman and special guest Olaf Witkowski, who is the director of research at Cross Labs and the current president of the International Society for Artificial Life.

Among many topics, the three of them discuss cellular automata, the origins of evolution, and the open-endedness of A-life.

How many creators will survive generative AI?

Think AI can't touch the creative world? Think again. Writers, directors, illustrators - none are safe. AI models, despite their glaring flaws, are on the verge of rendering the vast majority of 'creative' work obsolete. The digital age has already flooded the market with so-called 'creatives', and now AI threatens to wash the least original of them away. We're about to witness the dismantling of creative pathways and the death of apprenticeships. So, where does that leave the next generation of creatives? Video based on an essay by Danny Crichton

Our YouTube Ch

Lux Capital Music composed by George Ko Video shot, edited and produced by Chris Gates: Thumb image photography by MJP

We need to go deeper with the inception of deep geothermal energy

Historians survey the past and the Twitterati (X-erati?) process the events of the present day. But what does it mean to search the future for clues of what’s to come — and how much longer will we have to wait for it?

In this episode of “Securities”, Danny Crichton welcomes Lawrence Lundy-Bryan, research partner at Lunar Ventures and the publisher of “State of the Future”, a Deep Tech Tracker whose distinguishing feature is its extraordinarily wide remit to investigate the interstices of science and technology and find the morsels of innovative goodness that will power the planet in the years ahead. Also joining is Lux Capital’s own scientist-in-residence Sam Arbesman, who is certainly no stranger to the crazy ideas straddling science fiction and science fact.

Lawrence shares his unique approach to identifying and evaluating emerging technologies such as deep geothermal energy. We then pivot to exploring Lawrence’s approach of finding the future through the methodology of “horizontal scanning.” What’s to come? Listen and find out.

The Science of Survival: Adapting Human Life for Other Planets

Welcome to "Securities," a podcast and newsletter devoted to science, technology, finance, and the human condition. In this episode, Josh Wolfe and Danny Crichton bring science fiction into science fact with our guest, Christopher Mason, a geneticist and computational biologist who has been a principal investigator of 11 NASA missions and projects.

Mason, a professor of genomics, physiology and biophysics at Weill Cornell Medicine, discusses his book, "The Next 500 Years: Engineering Life to Reach New Worlds." The book explores the concept of protecting humanity from inevitable extinction by venturing to other planets. While most focus on the technologies to deliver us to these places, Mason takes a different angle, focusing on the biological adaptations necessary for humans to survive in space.

Mason discusses the need for both physical engineering and biological engineering in space travel. He highlights the importance of understanding and potentially engineering our microbiome for space travel, given its significant role in our health and digestion. He also discusses the potential of gene editing, using the example of the vitamin C gene, which we could potentially reactivate to allow humans to auto-synthesize vitamin C.

The conversation also covers the physical changes experienced by astronaut Scott Kelly during his time on the International Space Station and the implications of these changes for future space travel. Mason discusses the potential of engineering the perfect space specimen, considering factors such as gravity, radiation, and circadian rhythms.

The p-zombie theory of consciousness

The rise of generative AI and large-language models (LLMs) have forced computer scientists and philosophers to ask a fundamental question: what is the definition of intelligence and consciousness? Are they the same or different? When we input words into a chatbot, are we seeing the early inklings of a general intelligence or merely the rudiments of a really good statistical parrot?

These are modern questions, but also ones that have been addressed by philosophers and novelists for years, as well as the occasional philosopher-novelist. One of those rare breed is the subject of this week’s “Securities”, specifically the novel Blindsight, the first of two books in the Firefall series written by Peter Watts back in 2008. It’s a wild ride of dozens of ideas, some of which we’ll talk about today. Spoilers abound so caveat emptor.

Joining Danny Crichton is Lux’s own scientist-in-residence Sam Arbesman as well as Gordon Brander, who runs the company Subconcious, which is building tools of thought such as Noosphere, which is a decentralized network of your notes backed by IPFS, as well as Subconscious, which is a social network built around those notes that allows you to think together with others. Think of it as a multiplayer version of Roam.

We talk about a bunch of concepts today, from the distinction between consciousness and intelligence, Searle’s Chinese Room, the Scrambler consciousness test, whether consciousness is necessary for intelligence, and then for fun, a look at intelligence and the Large Language Models that have sprung up in generative AI. Approachable, but bold – just as Watts approaches his works.

"Securities" podcast is produced, recorded, and edited by Chris Gates

Fertility Rules from wildfire sperm death and microplastics to the potential of AI w/ Leslie Schrock

The birds and the bees just don’t cut it anymore. With the rising age of first pregnancies in America, optimizing fertility has become the linchpin for potential parents embarking on the journey to childbearing. Even so, we remain beholden to dozens of myths driven by inadequate science, even while we ignore the vast new potential — and limits — of a bountiful set of advanced technologies that aim to make fertility a more understandable and approachable subject.

“Securities” host Danny Crichton is joined by Leslie Schrock, venture investor and author of the new book “Fertility Rules: The Definitive Guide to Male and Female Reproductive Health”, to discuss the complex intricacies of the new science of fertility and why we have so much more to do to bridge the gap between expert knowledge and popular understanding.

The two discuss the connection between general health and fertility, why men need to do more around their health to ensure a successful pregnancy, why environmental pollutants like parabens and microplastics can affect fertility and sperm counts, how climate change is adding the bad kind of heat to the kindling of love, what new technologies are arriving for parents, and finally, what scope these technologies should have on the productive lives of people.

“There are more astronauts alive than there are perfumers”: the complex supply chains of scents

While the natural world is fecund with a dazzling diversity of smells, the landscape of scents in our daily lives is far less organic. A handful of tightly-held fragrance companies and an extremely small guild of perfumers carefully craft the scents that go into every product we purchase, from the scent of clean laundry in our detergents to the orchestrated beauty of scents that make up a modern perfume. Our memories are — without too much exaggeration — controlled by roughly 600 people globally.

Where do those scents come from though, and why are people increasingly concerned about understanding the ingredients that make up spectrum of smells that waft over us every day?

Returning to “Securities” for our second of two episodes on the science of smell, CEO and founder of Lux-backed Osmo Alex Wiltschko joins host Danny Crichton to talk about the extraordinarily intricate supply chains and the astonishingly pricey essences that go into making our products distinctive to our olfactory system.

We cover the dynamics of the fragrance industry, the incredible scale of land required to make scents today, how perfumers perform their craft, the endlessly complicated supply chains of these products, why we have so few alternatives to natural scents, how climate change is causing dramatic shifts in ingredient prices, and finally, a bit on the future of green chemistry.

“It subverts the structure even of other stories that are told about creation”

In a quantified world, the act of creation remains mysterious. Where do ideas come from? How does an artist translate a concept or a feeling into the final work that we get to read or view? The interior drama of that mystery becomes ever more visible as the singular artist expands into a collaboration. How do relationships change the trajectory and originality of creativity?

Few novels have better distilled the essence of these questions than Tomorrow, and Tomorrow, and Tomorrow by Gabrielle Zevin, which chronicles the multi-decade collaboration between two video game designers as they mature from grade school into the limelight of a cutthroat industry on the cusp of popular success. Inventive, heartfelt, and sophisticated, the novel was a breakout hit and was selected as Amazon’s book of the year for 2022.

This week on “Securities”, host Danny Crichton joins up with novelist Eliot Peper and Lux’s own scientist-in-residence Sam Arbesman to talk about the messages that the novel offers our own creative lives. We talk about the building of virtual worlds, the hero’s journey of creation, the uniqueness versus repetitiveness of producing art, whether video games are entering the literary zeitgeist, why the book garnered such popular success and finally, narratives of individuals versus groups.

“Smell can be art, and it also can be science”: AI/ML and digital olfaction

We perceive the world through our senses, watching the sunset, hearing the staccato of a violin soloist, smelling and ultimately tasting the chocolate and butter of freshly-baked cookies, and of course, feeling the touch of a loving partner. Yet while scientists have answered fundamental questions about color and audio, from understanding their physics to constructing mathematical representations of them, there remains a huge gap when it comes to smell.

Given how much more complex and higher dimensional it is, smell is an extraordinarily hard sense to capture, a problem which sits at the open frontiers of neuroscience and information theory. Now after many decades of discovery, the tooling and understanding has finally developed to begin to map, analyze and ultimately transmit smell.

Joining “Securities” host Danny Crichton is Alex Wiltschko, CEO and founder of Osmo, a Lux-backed company organized to give computers a sense of smell. He’s dedicated his life (from collecting and smelling bottles of perfume in grade school to his neuroscience PhD) to understanding this critical human sense and progressing the future of the field.

In this episode, we talk about smell and memory, the history of sense science, the mathematical challenges of modeling scent, the human physiology of smell and our surprising performance against even the best scientific lab equipment, the importance of chemical sensing, creating the digital olfaction group at Google Brain, how the mixture modeling problem remains the last and key frontier of this science, and finally, why the declining power of insect repellant is an important climate change challenge that the new science of smell can potentially solve.

How exponentials on top of exponentials in single-cell analysis is transforming biology today

It’s been a long road to mastering the cell, but biological scientists think they are getting closer and closer to understanding the fundamental mechanics of the kernels of life that make up our bodies. Decades after the sequencing of the first human genome, we now have a much more comprehensive understanding of how to discover a cell’s functions — and increasingly, the tools to actually analyze and prove that our models and theories about them are correct.

That’s been the domain of single-cell analysis and a novel technique in genetic science, which has been dubbed “perturbation biology”: making extremely small changes to the genetic code inside of cells and then observing how that cell’s functions change. What began with 18 cells and limited observational data in a single lab has now grown exponentially to hundreds of thousands of cells and millions of observations globally. That massive increase in data has forced the creation of a whole new set of analytical tools to process this data and derive foundational insights into the workings of cells.

How do all of these new laboratory experiments work and what kind of software tools are needed to progress the most advanced theories today? Joining host Danny Crichton on “Securities” this episode is Rahul Satija, an associate professor at New York University and a core member of the New York Genome Center as well as Lux’s own Shaq Vayda.

We’ll talk about how biological tools like CRISPR power perturbation bio, why scientists are increasingly moving away from indirect experiments to direct experiments and what that means for the future of the field, how we comprehend cell heterogeneity, if we’re getting closer to “fundamental truth” in biology, and finally, why theoretical molecular scientists are increasingly going to need large-scale clinical trials for the next-generation of health treatments.

First impressions of OpenAI’s new GPT-4 AI model

ChatGPT has overtaken the cultural zeitgeist faster than any consumer service in the history of technology, with some analysts estimating that it has already been used by more than 100 million people. So when OpenAI, ChatGPT’s creator, live-streamed the launch of its new AI model GPT-4, there was a rush of excitement reminiscent of the Apple product launches of the past.

It’s been about 24 hours since GPT-4’s public launch, and all of us here at Lux have already extensively played around with it, so it seemed apt for a rapid response “Securities” episode on our very first impressions. Joining host Danny Crichton is Lux Capital partner Grace Isford, who not only has been playing around with ChatGPT, but also Anthropic’s new bot Claude, which was a bit overshadowed between SVB’s situation and OpenAI’s announcement.

We talk about GPT-4 and what’s new, its new frontiers of performance, the increasingly impenetrable black box OpenAI is establishing around its company and processes, the company’s competitive dynamics with big tech, and much more.

Chatphishing, veracity and “two years of chaos and a reset”

The Lux LP quarterly letter has become an institution for its intricate weave of pragmatic cynicism about human nature and unbounded optimism about the power of human progress in the face of macroeconomic forces. We released the latest quarterly letter on the theme of “From Strife to Strive” just before the collapse of Silicon Valley Bank last week. With more strife than ever in the market, where will entrepreneurs strive next?

Joining me (Danny Crichton) to talk about our analysis of what’s coming in 2023 is our own Josh Wolfe, who predicts that Xi Jinping now plays a much larger oracular role for the American economy than even Warren Buffett. China’s competition with the U.S. is forcing venture investors and political leaders to reallocate capital much more aggressively toward the hard sciences — portending important advances ahead.

We also talk about open cultures, reconsideration of established truths and loss aversion, the online furor over induction stoves, Lux’s concept of “inner space, outer space and latent space”, the future of ChatGPT and the rise of what Josh dubs “Chatphishing”, the potential terrorism of 21st century Luddites, and finally, macro dynamics and why the chaos of the next two years will lay the foundation for the entrepreneurial striving in the decade ahead.

May the AI be ever in your favor

While much of the venture world has hit a reset in 2023, you’d never know that in artificial intelligence, where fire marshals are shutting down crammed engineering meetups and startups are once again raising at eye-watering valuations. Why the excitement? Because for founders, technologists and VCs, it feels like the everlasting promise of AI dating back to the 1950s and 1960s is finally on the cusp of being realized with the training and deployment of large language models like GPT-3.

To hear about what’s happening on the frontlines of this frenetic field, Lux Capital partner Grace Isford joins “Securities” host Danny Crichton to talk about what she’s seeing in 2023 across the AI tech landscape.

We talk about her impressions at the recent AI Film Festival in New York City hosted by Lux’s portfolio company Runway, how developers are being empowered with new technologies in Python and TypeScript and why that matters, and finally, how the big tech giants like Microsoft, Google and Amazon are carefully playing their cards in the ferocious competition to lead the next generation of AI cloud infrastructure.

“That’s 100% what keeps me up at night”: Gary Marcus on AI and ChatGPT

Artificial intelligence has become ambient in our daily lives, scooting us from place to place with turn-by-turn navigation, assisting us with reminders and alarms, and guiding professionals from lawyers and doctors to reaching the best possible decisions with the data they have on hand. Domain-specific AI has also mastered everything from games like Chess and Go to the complicated science of protein folding.

Since the debut of ChatGPT in November by OpenAI however, we have seen a volcanic interest in what generative AI can do across text, audio and video. Within just a few weeks, ChatGPT reached 100 million users — arguably the fastest ever for a new product. What are its capabilities and perhaps most importantly given the feverish excitement of this new technology, what are its limitations? We turn to a stalwart of AI criticism, Gary Marcus, to explore more.

Marcus is professor emeritus of psychology and neural science at New York University and the founder of machine learning startup Geometric Intelligence, which sold to Uber in 2016. He has been a fervent contrarian on many aspects of our current AI craze, the topic at the heart of his most recent book, Rebooting AI. Unlike most modern AI specialists, he is less enthusiastic about the statistical methods that underlie approaches like deep learning and is instead a forceful advocate for returning — at least partially — to the symbolic methods that the AI field has traditionally explored.

In today’s episode of “Securities”, we’re going to talk about the challenges of truth and veracity in the context of fake content driven by tools like Galactica; pose the first ChatGPT written question to Marcus; talk about how much we can rely on AI generated answers; discuss the future of artificial general intelligence; and finally, understand why Marcus thinks AI is not going to be a universal solvent for all human problems.

Why quitters are heroes with “Quit” author Annie Duke

They say that you miss 100% of the shots you don’t take, but what if each shot costs money and is actually a tradeoff with taking a different shot? Time and money are limited, and that means we must constantly balance investing in our current projects and ideas against seeking out new opportunities. While there has been prodigious work published on how to find the “next big thing”, few researchers have investigated what it takes to just throw in the towel, jump ship, fold and quit in the face of a bad situation.

Joining us on “Securities” today is Annie Duke, a World Series of Poker champion who researches cognitive psychology at the University of Pennsylvania. She recently published her new book “Quit: The Power of Knowing When to Walk Away,” which explores the nature of quitting, the cognitive challenges in confronting loss, and the tactics required to identify when to quit — and how to do so.

In conversation with Lux Capital’s own Josh Wolfe, the two discuss the challenges of walking away, why professional poker players are better at quitting than amateurs, the geopolitics of war, and the importance as always of premortems for quitting.

“I have three girls; the second one is bionic”

Technology’s prime and still growing role in society has led to a crescendo of criticism that it has exacerbated inequality. Critics say that the economic models and algorithms underpinning out apps and platforms are tearing apart our social fabric, fracturing the economy, casualizing labor, and increasing hostility between nations.

But for all the negativity around technology, there is a parallel positive story of how technology can empower people to achieve their best lives. Whether it’s dynamically adjusting insulin pumps that allow diabetics greater freedom to pursue their dreams, or reliable algorithms that can reduce human bias in everything from hiring to dating, technology has also added tremendous value to society.

That’s the theme of “The Equality Machine: Harnessing Digital Technology for a Brighter, More Inclusive Future,” a new book by Orly Lobel, the Warren Distinguished Professor of Law and Director of the Center for Employment and Labor Policy at the University of San Diego.

Lobel joins host Danny Crichton to talk about how her daughter became bionic, why alarmist titles of recent critical tech books belie the comparative advantage of algorithms, the actual black box of human minds, feedback loops in doctor’s offices and the medical professions, and finally … sex robots. Because they have feelings (and algorithms) too.

We will observe a battle for the true openness in AI

No technology has as many dual-use challenges as artificial intelligence. The same AI models that invent vivacious illustrations and visual effects for movies are the exact models that can generate democracy-killing algorithmic propaganda. Code may well be code, but more and more AI leaders are considering how to balance the desire for openness with the need for responsible innovation.

One of those leading companies is Hugging Face (a Lux portfolio company), and part of the weight of AI’s safe future lies there with Carlos Muñoz Ferrandis, a Spanish lawyer and PhD researcher at the Max Planck Institute for Innovation and Competition (Munich). Ferrandis is co-lead of the Legal & Ethical Working Group at BigScience and the AI counsel for Hugging Face. He’s been working on Open & Responsible AI licenses (“OpenRAIL”) that fuse the freedom of traditional open-source licenses with the responsible usage that AI leaders wish to see emerge from the community.

In today’s episode, Ferrandis joins host Danny Crichton to talk about why code and models require different types of licenses, balancing openness with responsibility, how to keep the community adaptive even as AI models are added to more applications, how these new AI licenses are enforced, and what happens when AI models get ever cheaper to train.

There’s always been a global race to develop chip technology

Semiconductors are ubiquitous in modern life, powering our appliances, smartphones, cars and electronics. That’s led to soaring demand from consumers, companies and governments much to the chip industry’s benefit, but its centrality to the global economy has also brought heightened scrutiny from analysts concerned by the deep dependency we have on a handful of companies around the world producing these products.

The semiconductor industry is now on the front pages of news sites almost daily, but its story and history show that this isn’t a new development, but rather a continuation of decades of globalization and competitions for international economic supremacy.

“Securities” host Danny Crichton is joined by Fletcher School professor Chris Miller, whose new book “Chip War: The Fight for the World’s Most Critical Technology” offers a panoramic global view on one of the world’s most important industries. The book has already been shortlisted for best business book of the year by The Financial Times.

Perhaps our greatest achievement is not being present

We live in a time of tremendous focus on … focus and productivity. Scan the shelves of any self-help section in a bookstore and you’ll find copious volumes on how to focus better, deeper, and longer along with a litany of productivity hacks and habits to efficiently glean. What you will often struggle to find however are books advocating doing nothing. But when it comes to creativity and making deep connections, it’s precisely when we are wandering that we are most focused on invention.

To talk more about cognitive science and psychology, I, Danny Crichton, brought local New York City professor Anna-Lisa Cohen on “Securities” to talk about her research into mind wandering and how we balance present actions with future intentions. Her work became a viral hit during the pandemic after a Washington Post op-ed she penned on “mental time travel” struck a nerve (yes, that’s a cognitive sciences pun) for many suffering during the isolation at the heights of Covid-19.

We talk about our brain’s default mode network, why mind wandering shouldn’t get a bad rap, peak performance and generating novel concepts, what it means to focus on not focusing, carrying out future intentions and prospective memory, the psychology of film and particularly a look at Alfred Hitchcock’s “Bang! You’re Dead”, cognitive closure and its effect of information seeking, and finally, future simulations.

Reference list:

The unusual uses task study: https://pubmed.ncbi.nlm.nih.gov/22941876/

The freestyle rapper and fMRI study: https://www.nature.com/articles/srep00834

Hitchcock film study: https://pubmed.ncbi.nlm.nih.gov/26658578/

How the Brain Reacts to Scrambled Stories : https://www.theatlantic.com/health/archive/2016/01/linear-storytelling-psychology/431529/

Reading Literary Fiction makes us better decisionmakers: https://www.tandfonline.com/doi/abs/10.1080/10400419.2013.783735?cookieSet=1

Marginal stupidity: https://www.getrevue.co/profile/lux_capital/issues/securities-by-lux-capital-marginal-stupidity-1209105

Web3 is so far behind in terms of reliability and security

Episode reading list:

The future of crypto regulation: Highlights from the Brookings event

Lux + Tactic funding announcement

Fourteen years after the release of the Bitcoin white paper, Web3 and crypto are transitioning into adolescence. Technologies and communities that have collectively been a financial Wild West are slowly but inexorably transforming into mainstream infrastructure powering payments, finance, banking, and even identity and data storage. That transition though is hampered by a data and security stack that remains, let’s just say, well below the norms expected for modern software (which itself is below the expectations for data protection that consumers actually demand).

The gap between the visions of a secure Web3 future and today’s current technology is the opportunity to propel crypto through its awkward teen years.

I, Danny Crichton, wanted to talk more about where Web3 infrastructure is headed, and so I asked my Lux Capital partner Grace Isford as well as Ann Jaskiw, founder and CEO of crypto accounting platform Tactic, to walk through today’s looming clouds in crypto regulations and why the future is about to get a whole lot brighter.

We discuss Grace’s investment in Tactic and how Ann migrated from building secure healthcare technologies to figuring out accounting for the crypto world. We then talk about the Web3 infrastructure stack and its pockmarked reliability, The Merge’s effect on Ethereum’s future and Vitalik Buterin’s leadership role in the energy-saving transition, international dimensions of crypto security, as well as how the SEC is pivoting toward crypto regulation and why crypto founders are increasingly pro-regulation.

How to recapitalize America’s bloated defense industrial base

Episode reading list:

Forging the Industrial Network the Nation Needs

Rebooting the Arsenal of Democracy

The Return of Industrial Warfare

America spends more money on defense than ever, with a budget that more than doubled in the wake of the September 11th terrorist attacks. Despite those dizzying appropriations though, America is now down to just 5 big prime defense contractors, consolidated from dozens during the Cold War. It’s a pattern of consolidation, higher costs, and diminished resiliency and flexibility seen in sectors throughout the U.S. economy. As the stakes have grown for American defense, however, there are increasingly acute concerns about what our diminished capacity for defense means for the country’s long-term security.

Today, we bring on James “Hondo” Geurts to talk more about the crisis in the defense industrial base. Geurts most recently performed the duties of the Under Secretary of the Navy and formerly was Assistant Secretary of the Navy for Research, Development & Acquisition, in charge of the Navy’s more than $100 billion annual budget.

Lux Capital is also deeply interested in recapitalizing the future of the defense industrial base and bringing more attention to emerging threats across all theaters of defense, including cyber, space, networking, and more in both state and civilian contexts. To that end, Hondo and Lux teamed up to create the Lux Security + Tech Index built on Thematic to offer investors a more methodical way to invest in the future of security. Also joining host Danny Crichton is Steve Carpenter, CEO and founder of Thematic.

In this episode, we talk about the importance of the new “industrial network” era of defense, the consequences of the 1990s post-Cold War peace dividend, how large projects like the F-35 and the Gerald R. Ford aircraft carrier drive consolidation, the value of simplicity in defense acquisition, the failure of the Defense Department’s high research expenditures, the need to shift from “program of record” to “capability of need”, and finally, details about the new Lux Security + Tech Index and its construction.

As a reminder, all investments are risky, and nothing in this episode should be construed as an endorsement of any specific investment product for any individual listener. Always do your own research.

The utopian visions of Stanford’s generations of entrepreneurs

Stanford University is at the beating heart of Silicon Valley and has become almost a rite of passage for generations of entrepreneurs. But how does each generation form, and what skills and mindsets should they be equipped with given our changing world?

No one has thought more about how to shape that entrepreneurial spirit than Dr. Tina Seelig. Seelig is the Executive Director of the prestigious Knight-Hennessy Scholars program at Stanford among many other leadership roles, and she is also the author of Creativity Rules: Get Ideas Out of Your Head and into the World as well as What I Wish I Knew When I Was 20. Joining Seelig is host Danny Crichton and Lux Capital partner Grace Isford.

We talk about Seelig’s class “Inventing the Future” and how she guides students in considering the utopian and dystopian aspects of the future technologies that are shaping our everyday lives. We also talk about generational differences between students over the past two decades, from the 9/11 generation to the global financial crisis and Covid-19 generations and how global events influence the approach of budding entrepreneurs. Then we walk through how to teach leadership, how to increase luck, and why there is such an important correlation between optimism and agency.

The geopolitics and digital future of agricultural commodities

Agricultural commodities is a bit like accounting: you only hear news stories about it when things go wrong. And unfortunately for the world in 2022, a lot is going wrong in agriculture. Russia’s war on Ukraine has devastated one of the world’s great breadbaskets, and global climate disruptions are wrecking havoc on food productivity. That’s led to soaring inflation and increasingly contentious politics, particularly in the developing world.

Sadly, that’s not the only problem the industry faces. Commodities are still traded predominantly on antiquated systems, with the UN estimating that more than 275 million emails are exchanged annually to ship about 11,000 vessels of grain across the oceans. That’s one reason why Lux led the $7 million seed round for Vosbor earlier this summer to build the first digital agricultural commodities exchange.

I wanted to understand more of this extraordinarily complex industry, and so I asked two former CEOs of the largest agriculture commodities companies in the world to weigh in. Joining me (@DannyCrichton) on “Securities” today is Chris Mahoney, former CEO of Glencore Agriculture and now known as Viterra, as well as Soren Schroder, former CEO of Bunge.

We’ll talk about the cyclicality of agricultural markets, the cost disease of infrastructure upgrades, the geopolitical strategies of ag firms, the increasing focus on logistics capabilities, and what the future of digitalization and technology have in store for this critical industry.

Reputations are always a trailing indicator of truth

“Securities” podcast host Danny Crichton and producer Chris Gates talk about the latest newsletter issue, “Truth and reputations.” Reputations are always a trailing indicator of truth. When people and organizations are rising, reputations obviously lag — the public has never heard of these new upstarts, and its opinion remains unformed. Reputations gallop to catch up, and for a brief moment perhaps, the true quality and the perceived quality intersect. Inevitably decline sets in, whether in an individual’s career or in an organization’s penchant for adding listless bureaucracy and complexity. The public reputation remains robust, but the underlying quality has etiolated. Perception has now overshot truth.Last week, we saw three stories that illuminate the dynamics of truth versus perception: Adam Neumann’s $350 million fundraise for Flow; SoftBank’s historic quarterly loss and Masayoshi Son’s investment acumen; and then, the CDC director’s call for a complete reform of her beleaguered agency. We talk about these three stories, plus a Lux Recommends article.

Crypto and incentive design with MIT Cryptoeconomics Lab’s Christian Catalini

Humans have been bartering and trading for millennia, building extraordinarily complex mechanisms of exchange centered on fiat currencies, contracts, and trust. As cryptocurrencies have emerged this past decade, economists and incentive designers have been forced to consider how to construct new forms of currency without the social lubricant of trust. How can we prove that every market participant is incentive aligned with market goals? What contributions can game theory, theoretical computer science, cryptography and microeconomics make to this newly energized field?

That’s the subject of this episode of “Securities” with Christian Catalini, the founder of the MIT Cryptoeconomics Lab. He and his colleagues fuse the fields of economics and computer science together with the goal of analyzing decentralized marketplaces and applications. It’s just the latest endeavor for Catalini, who is also a Research Scientist at the MIT Sloan School of Management, the co-creator of Diem (formerly known as Libra), and the co-founder and Chief Strategy Officer at Lightspark. Joining host Danny Crichton is Lux’s own Grace Isford, who invests in web3 and crypto infrastructure and is based in New York City. We’ll talk about the growing community of crypto infrastructure analysts, the now-famous MIT Bitcoin Experiment, how academics are translating their work into crypto, and how to think about stablecoins in the aftermath of Luna’s collapse this year.

VC 101: the denominator effect

Recently in the Lux Capital office, my colleague Chris Gates, the producer of the "Securities” podcast, along with biotech investor Shaq Vayda were talking about the global macro environment and venture capital. Tech stocks hit their zenith in November 2021, and now a lot of VCs have slowed down their investments over the last couple of months. That's led to something among limited partners and asset allocators known as the “denominator effect”, where portfolio managers move money from one asset class to another as each asset class performs relatively differently.

And so they talked about the denominator effect, they talked about a couple of other different patterns that they’re seeing in the venture world, and I figured that since it's summer, and it's July and we’ve already have talked about enough terrible news on the “Securities” podcast the last couple of weeks, I figured we could do something a little bit different, which is sort of a Venture 101 on the denominator effect, and talking about basically what we're seeing in the world today. So here's Shaq and Chris, take a listen.

Suggested reading:

How new communities are propelling the future of tech + bio

There has been a massive expansion in data emanating from bio labs, and that means next-generation AI algorithms and machine learning models finally have the grist to transform the future trajectories of biology and health therapies. Yet, there’s a key translation challenge: how do you get computer scientists and biologists — two types of specialists with very different training — to collaborate with each other effectively?

Two groups, Bits in Bio and Nucleate, have independently spearheaded new ways of bringing all people interested in tech and biology together to share best practices and think through patterns of startup inception and growth. Today, we bring the founders and early champions of those two groups together for the first time in person to talk about their work.

Joining us first is Michael Retchin, a PhD student at Weill Cornell Medicine and the founder of Nucleate, a free and collaborative student-run organization that facilitates the formation of pioneering life science companies. Second, we have Nicholas Larus-Stone, the first software engineering hire at Octant.bio, a Lux-backed synthetic biology startup, as well as the founder of Bits in Bio. Finally, joining “Securities” host Danny Crichton is Lux biotech investor Shaq Vayda.

We talk about where tech + bio (versus “biotech”) is coming from, how the two community leaders launched and grew their respective organizations, the coming challenges in biology, and our speculative dreams for the future of what biology could look like in the years ahead.

Maybe the world is effing amazing and I am just reading the wrong things

“Securities” podcast host Danny Crichton and producer Chris Gates talk about the last two weeks of “Securities” newsletters. The first, from July 9th called “Dissonant Loops”, discussed the chaos and crises plaguing the world today and why our state capacity to respond to them is so limited. The second, from July 16th entitled “Scientific Sublime”, was a palette cleanser of sorts focused on the human achievement of the James Webb Space Telescope and how this accomplishment can be shared by everyone on Earth. We’ve got the lows and the highs, and then we talk about a few of the top Lux Recommends selections from the two issues, including: “Postcards from A World on Fire” from The New York Times last year showing the scale and diversity of climate devastation IEEE’s overview of the daunting data challenges that come from transmitting those gorgeous images to Earth CLIPasso, a Best Paper awardee at SIGGRAPH 2022, which uses machine learning to abstract complex photography into simpler sketches “Building an Open Representation for Biological Protocols” Daniel Oberhaus’s book Extraterrestrial Languages, which asks two provocative questions, “If we send a message into space, will extraterrestrial beings receive it? Will they understand?” Finally, Kit Wilson’s analysis in The New Atlantis on “Reading Ourselves to Death”